Numerous indicators are pointing to a bleak Las Vegas economic condition: Gaming revenue is down, casino stocks have cratered, taxable sales are falling, unemployment is rising, and small businesses are failing across the state; additionally, foreclosures are increasing, retail spaces sit empty, new home sales are in the toilet, strip construction projects face potential bankruptcy, State/county budgets are in the red and many nationwide headlines read: "Nevada’s economy dead last."

With this said, I've posted numerous articles discussing many of these various LV economic issues in the past (see lower right side of this Blog under ** Las Vegas Downturn** for links), so today I plan to focus on just a few key areas.

- Real estate crisis/foreclosures

- Bankruptcies/courts

- Repo Business

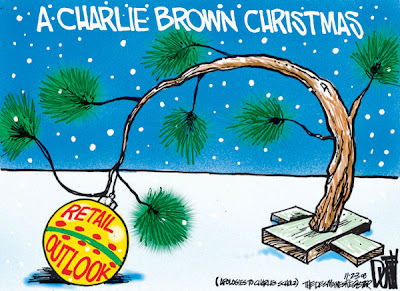

- Retailers

- Unemployment

- Growing local hardships

Las Vegas: Real Estate in Crisis

The subprime mortgage crisis is hitting the Las Vegas metro area particularly hard. In fact, Nevada has the highest foreclosure rate in the country and the metro area is consistently one of the top five worse in the nation.

The crisis entails homeowners losing their houses after they are unable to afford their mortgage payment. It was brought about by lenders and banks giving risky loans, or subprime mortgages, to people with poor credit scores or finances. Low interest rates first attracted such homebuyers. However, as many loans were adjustable rate mortgages (ARMs), higher interest rates down the road made payments nearly impossible, ultimately leading to foreclosure. Furthermore, predatory lenders have been accused of perpetuating the situation by unfairly taking advantage of uninformed or new buyers. There were a large number of investors who bought homes at the height of the market and expected to flip them for a profit, only to see values decline.

Few options are available for those unable to make a mortgage payment or facing foreclosure. The state of Nevada has established an 800 number for homeowners facing mortgage problems. At the national level, President Bush and lenders agreed to a plan to a five-year freeze on loan rates for those homeowners who qualify and discussion are underway to expand those eligible.

Nevada leads nation in rate of foreclosures

Nevada had the highest foreclosure rate in the nation in the second quarter of the year, according to data released today.

Calif.-based RealtyTrac Inc. said one in every 43 Nevada households received a foreclosure filing, which is nearly four times the national average of one in every 171 households. The rate was even higher in Las Vegas, where one in every 35 households received a foreclosure notice last quarter.

How Many Foreclosures?

Realtytrac currently indicates ~ 60,000 are in some state of foreclosure.

Foreclosure kills huge project near mountain

When Focus Property Group gathered eight homebuilders and purchased 1,710 acres of government land at the base of Kyle Canyon in 2005, it promised to extend Las Vegas still farther into the desert, delivering suburbia to the doorstep of Mount Charleston.

The group put down $510 million for the property, snapped up at a Bureau of Land Management auction at a time when developers of master-planned communities were paying top dollar to feed their homebuilding habits.

This project, approved by Las Vegas for as many as 16,000 homes, wouldn’t be as large as Focus Property Group’s Mountain’s Edge master planned community, but would be larger than its Providence.

This project was called Kyle Canyon Gateway.

But that was then.

Without a single home being built, the property has been foreclosed on by its lender, Wachovia Bank, said John Ritter, chief executive of Focus Property Group.

In October, Wachovia, which is being taken over by Wells Fargo, sued Focus and its eight partners for defaulting on payments for the northwest Las Vegas development.

Focus owned 23 percent of the project. The other partners were Toll Brothers, Lennar, Pulte, KB Home, Kimball Hill Homes, Woodside Homes, Meritage Homes and Ryland Homes.

Bank Owned Homes Left Trashed

Thousands of foreclosed homes fill neighborhoods all across the valley.

And the people living in those neighborhoods are putting up with a lot more than an empty house.

Three out of five foreclosed homes in Las Vegas are trashed and it not only creates an eyesore for the community, but a target for criminals.

It's not just the homeowners leaving a mess.

When a house sits empty for a while its an easy target for thieves.

At one house the entire air conditioning unit was stolen.

The bank wants to get rid of properties like this as soon as possible.

Since you get it as is, you get a good price.

"We're seeing prices in some communities where the bank owned homes are actually selling for less than the builder sold them for when the community was first sold," Heyworth says.

Now if Las Vegas can only find more buyers.

Closing:

Several years ago I received quite a bit of ridicule for forecasting many of these issues - going against the grain of the ignorant, yet widely prevailing "Las Vegas is recession proof" goldilocks viewpoint, and up to ~ 18 months ago many "economic experts" were still in denial. Today however, the data is hard to refute - the Las Vegas economic condition is bad.

With that said, if you want to listen to and believe these same pundits who denied this downturn at every step of the way, and who now claim the local economy will rebound in mid-2009, be forewarned - it will not - though bad today, the Las Vegas economic condition will get far worse over the coming months and years.

Regards

Randy