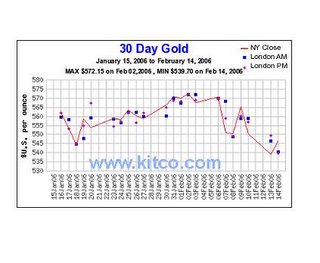

With that said, Gold is typically a long-term investment and the overall trend for gold is UP. Many suggest we should take these corrections as a time to increase positions, as these low prices may not be available for too long.

Numerous current issues are having an impact on the gold market: Gold prices are close to a 25 year high, Oil prices are lowering due to increasing inventories and the warmest winter on record; many Japanese investors are liquidating their long positions on the Tokyo exchange and the dollar is gaining strength on speculation of further Fed Rate increases (beyond the near guaranteed increase in March).

Bottom line: This wild ride is merely a “Shaking of the Branches” if you will, and the loose acorns are definitely falling. I hope this consolidation doesn’t spook you into taking any unnecessary losses. I believe the long-term trend is UP, UP, UP and will not personally allow this situation to spook me.

Regards... Randy

NOTE: This article is not to be taken as investment advice. It is merely my thoughts on the current gold market and is only being offered as food for thought…

6 comments:

It's still not common knowledge the huge debts we have. I ask smart people with graduate degrees how much debt they think we have, and they have no idea. I think the mortgage industry alone increased debt by like 5 trillion dollars in the last few years.

When it becomes common knowledge the true debt and shakiness that are in this market, i'm 'betting' gold will skyrocket.

Rising Gold price is an alarm bell to investors that our government has an interest in quieting. Alan Greenspan said that the rise in Gold "did not reflect inflation or the strength of commodities, but rather a fear among investors of a major geopolitical conflict" in other words it is just speculation. Of course, what else could it be?

I agree- this is a great buying opportunity. As a long term play, gold is a safe investment given the ongoing global economic imbalances. Oh yes, and of course, any geopolitical conflicts.

Alan Greenspan said that the rise in Gold "did not reflect inflation

So the trillion dollar increases in debt will be paid off as the years go by? And the supply of money will shrink? That's what you think?

Agreed, gold is set to go up when the dollar weakens. However the day-to-day markets only care about US's fed rate. So until traders have "priced in" 5% rates, we might have a bumpy ride which will allow for more buying periods.

Home loan processing center cut backs! Because, "Slower demand for Mortages".

Washington Mutual Trimming 2,500 Jobs

Wednesday February 15, 10:16 pm ET

By Elizabeth M. Gillespie, AP Business Writer

SEATTLE (AP) -- Washington Mutual Inc., the nation's largest savings and loan, said Wednesday it will cut 2,500 jobs in the coming months by closing 10 home loan-processing centers and more than three dozen smaller support offices as it trims staff to match slower demand for mortgages.

The cuts represent about 4.2 percent of Washington Mutual's 60,000 employees.

Tim McGarry, a spokesman for the Seattle-based company, said the 10 largest offices being closed are in Chatsworth, Campbell, and Stockton, Calif.; Dedham and Quincy, Mass.; Lake Worth, Fla.; Lancaster, Pa.; Lake Oswego, Ore.; Novi, Minn., and Columbia, S.C. About 1,500 employees work in those offices.

Post a Comment