Numerous indicators are pointing to a bleak Las Vegas economic condition: Gaming revenue is down, casino stocks have cratered, taxable sales are falling, unemployment is rising, and small businesses are failing across the state; additionally, foreclosures are increasing, retail spaces sit empty, new home sales are in the toilet, strip construction projects face potential bankruptcy, State/county budgets are in the red and many nationwide headlines read: "Nevada’s economy dead last."

With this said, I've posted numerous articles discussing many of these various LV economic issues in the past (see lower right side of this Blog under ** Las Vegas Downturn** for links), so today I plan to focus on just a few key areas.

- Real estate crisis/foreclosures

- Bankruptcies/courts

- Repo Business

- Retailers

- Unemployment

- Growing local hardships

Las Vegas: Real Estate in Crisis

The subprime mortgage crisis is hitting the Las Vegas metro area particularly hard. In fact, Nevada has the highest foreclosure rate in the country and the metro area is consistently one of the top five worse in the nation.

The crisis entails homeowners losing their houses after they are unable to afford their mortgage payment. It was brought about by lenders and banks giving risky loans, or subprime mortgages, to people with poor credit scores or finances. Low interest rates first attracted such homebuyers. However, as many loans were adjustable rate mortgages (ARMs), higher interest rates down the road made payments nearly impossible, ultimately leading to foreclosure. Furthermore, predatory lenders have been accused of perpetuating the situation by unfairly taking advantage of uninformed or new buyers. There were a large number of investors who bought homes at the height of the market and expected to flip them for a profit, only to see values decline.

Few options are available for those unable to make a mortgage payment or facing foreclosure. The state of Nevada has established an 800 number for homeowners facing mortgage problems. At the national level, President Bush and lenders agreed to a plan to a five-year freeze on loan rates for those homeowners who qualify and discussion are underway to expand those eligible.

Nevada leads nation in rate of foreclosures

Nevada had the highest foreclosure rate in the nation in the second quarter of the year, according to data released today.

Calif.-based RealtyTrac Inc. said one in every 43 Nevada households received a foreclosure filing, which is nearly four times the national average of one in every 171 households. The rate was even higher in Las Vegas, where one in every 35 households received a foreclosure notice last quarter.

How Many Foreclosures?

Realtytrac currently indicates ~ 60,000 are in some state of foreclosure.

Foreclosure kills huge project near mountain

When Focus Property Group gathered eight homebuilders and purchased 1,710 acres of government land at the base of Kyle Canyon in 2005, it promised to extend Las Vegas still farther into the desert, delivering suburbia to the doorstep of Mount Charleston.

The group put down $510 million for the property, snapped up at a Bureau of Land Management auction at a time when developers of master-planned communities were paying top dollar to feed their homebuilding habits.

This project, approved by Las Vegas for as many as 16,000 homes, wouldn’t be as large as Focus Property Group’s Mountain’s Edge master planned community, but would be larger than its Providence.

This project was called Kyle Canyon Gateway.

But that was then.

Without a single home being built, the property has been foreclosed on by its lender, Wachovia Bank, said John Ritter, chief executive of Focus Property Group.

In October, Wachovia, which is being taken over by Wells Fargo, sued Focus and its eight partners for defaulting on payments for the northwest Las Vegas development.

Focus owned 23 percent of the project. The other partners were Toll Brothers, Lennar, Pulte, KB Home, Kimball Hill Homes, Woodside Homes, Meritage Homes and Ryland Homes.

Bank Owned Homes Left Trashed

Thousands of foreclosed homes fill neighborhoods all across the valley.

And the people living in those neighborhoods are putting up with a lot more than an empty house.

Three out of five foreclosed homes in Las Vegas are trashed and it not only creates an eyesore for the community, but a target for criminals.

It's not just the homeowners leaving a mess.

When a house sits empty for a while its an easy target for thieves.

At one house the entire air conditioning unit was stolen.

The bank wants to get rid of properties like this as soon as possible.

Since you get it as is, you get a good price.

"We're seeing prices in some communities where the bank owned homes are actually selling for less than the builder sold them for when the community was first sold," Heyworth says.

Now if Las Vegas can only find more buyers.

A boom era for Nevada bankruptcy lawyers

Nevada leads the nation in the per capita increase of bankruptcy filings compared with a year ago. In October, bankruptcies were up 70 percent compared with the same month last year, according to Automated Access to Court Electronic Records, a company that tracks bankruptcy data. Other Western states, including California and Arizona, are also high on the list.

The crash of the housing market, which punctured Las Vegas’ building bubble with particular force, is driving the increase. Law firms report a majority of their clients are resorting to bankruptcy because of foreclosure. (Nevada also leads the nation in the rate of home foreclosures.)

“People are using credit cards to hold onto their houses and getting cash advances to try and catch up. They do what they have to do to stay in the house. It’s a never-ending cycle,” attorney Ellen Stoebling said.

Adds Melissa Cain, of Cain Law Group: “It’s not like they come in with bills for TVs or clothing. They’re just trying to scrape by.”

On any given day, in the high-ceiling, wood-paneled courtrooms, rows and rows of lawyers wait for their turn before the judge. Many of the motions take less than a minute because much of the docket is full of unopposed motions to, in lawyer speak, lift stay. To the rest of us that means the homeowner is willingly surrendering the house.

“People are just in droves giving up their homes,” Stoebling said.

The owners don’t have to be in court for the swift but, one would imagine, gut-wrenching action.

“... the motion is brought forward ... pursuant to terms set forth ... fees are approved for the realtor...,” the judge says in a dry monotone, leaning with both arms folded on the bench.

And it’s done. The lawyer presenting the motion books it out of the courtroom.

Sometimes only one lawyer is presenting the case, but frequently a case will attract multiple attorneys, representing the debtor, the banks, the trustee and other interested parties.

“I don’t like to talk about the economy going down the drain,” he said. “While I’m busier, it’s incredibly disheartening to see this happening. I’m happy that I’m busy but very sad for the reason why.”

And some bankruptcy lawyers — the ones who represent banks — worry about getting paid. The banks had budgeted for a few filings a month, not tens and tens of filings.

“Probably a lot of the work I’m doing will be for free,” he said. “It’s not all party hats and balloons.”

Financial Cases Straining Courts

Clark County Court Administrators say the sagging economy is putting a strain on the local justice system.

With more foreclosures, evictions, and debt problems, the court is seeing a record number of economic-related cases being filed.

"We have seen a big growth in our summary eviction department," said Norma McMahan with Legal Process Service.

McMahan says the sheer volume of economic-related cases has doubled in the past year, "We are very busy, we are grateful for that, at the same time it is a true reflection of the economy and the effects that it is having on the people here."

Most cases involving foreclosures, evictions and bad credit card debts end up with the clerk of the Las Vegas Justice Court.

"With the economic downturn, the Justice Court has really seen as exponential increase in the number of documents filed. Those relate not just to evictions and foreclosure evictions but also the collection-type suits," said James Vilt. "A lot of people are clearly defaulting on their credit card payments and their creditors are coming after them."

So far this year there have been more than 20,000 eviction cases filed with the Las Vegas Justice Court. Justice Court officials say they believe they are just at the beginning of this trend where more financial-related cases are being filed than ever before.

Repo Men Reaping Rewards In Bad Economy

LAS VEGAS -- Repo men around the country are working harder than ever before.

One repo man told Las Vegas TV station KVVU that it was always an exciting and dangerous job, but now their work is exacerbated by so many people going broke.

"Volume-wise, business has doubled," said Justin Zane, co-owner of Zane Investigations.

One of Zane’s main services is repossessing property.

"Our clients are the banks -- lenders, finance companies," Zane said.

KVVU Reporters joined Zane recently as he took a car in Las Vegas.

"We're coming into these apartments where a spotter located a car we've been looking for. It’s supposed to be on the backside of the building here. She followed the guy for 45 minutes this morning. This is where he parked it. We're hoping the car is still there," Zane said.

Zane said he was looking for a newer model Dodge Neon.

Zane located and verified the car. It only took about a minute for his truck to grabs a hold of the vehicle, but he was on the lookout for anyone coming.

"It's been a little more dangerous as of late because now, we are down to stealing people's primary property -- primary modes of transportation," he said.

"A lot of people are embarrassed -- take a defensive stance. In general, most people know we're coming. They've talked to the bank, and the bank told them, 'If you don't pay, we'll be coming,'" Zane said.

Zane said he has been reclaiming motorcycles, boats, semi-trucks and more expensive cars due to the high cost of gas and the economy.

"Before it used to be mid-range … We're talking a lot of high end cars," Zane said.

He said with the economic crisis, basically everything, and anything, is fair game.

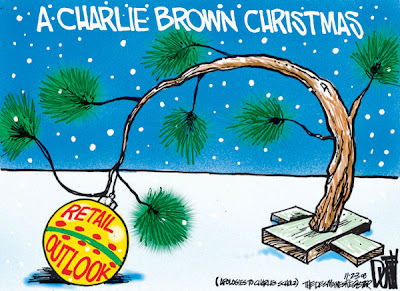

Retailers: Struggling to hang on

As businesses in shopping centers close, decreased foot traffic threatens the survivors.

Without close inspection, you could chalk up the receding monthly sales at the Maui Wowi smoothie shop to cooling temperatures. But slumping sales began in April. You could argue that fewer people today can afford a $4 or $6 smoothie. But Maui Wowi also sells 99-cent coffee.

Co-owner Paul Goldberg has a different theory: declining foot traffic at Spanish Trail Business Park, on Rainbow Boulevard near Tropicana Avenue.

In recent months, four stores near Maui Wowi vacated the 14-month-old marketplace: Jersey Mike’s sub shop, Carmine’s Pizza, Mail Trail and a Hurricane Grill and Wings. Only two remain open, the Maui Wowi franchise and LT Nails & Spa.

And it doesn’t help that most of the new office suites in the rear of the complex still don’t have tenants — another source of smoothie and spa customers.

A kind of unprecedented commercial blight in what for decades had been a boomtown is creeping over retail centers like a cancer, stigmatizing the struggling businesses that remain. Who wants to move into a shopping center where an increasing number of stores are closing and any retail synergy that might have existed has collapsed?

In the third quarter, the vacancy rate valley-wide topped 5 percent, nearly double from a year earlier, according to a report by analyst John Restrepo of the Restrepo Consulting Group.

The vacancy rate may be higher, said Rob Moore, managing director of investment sales and leasing at Gatski Commercial, which handles leasing of the Spanish Trail storefronts.

Applied Analysis, a market research firm, pegs the vacancy rate at 6.3 percent.

Paco Underhill, founder of international market research firm Envirosell, predicts the national retail vacancy rate will creep to 20 percent — and higher in some markets. The age, location and branding of shopping malls will dictate which ones have the best prospects of surviving the worsening recession.

Mike Krien, president of the National REO Brokers Association, said “retailers are having a heart attack. Everybody’s scared because no one’s spending money.”

Landlords are struggling to find replacement tenants, offering handsome incentives to little avail: rent discounts of up to 10 percent; a few months of free rent in exchange for three- or five-year leases; and site improvements.

Nevada jobless rate keeps spiking - jumps to 7.6% (Las Vegas at 7.5%)

Nevada's jobless rate hit 7.6 in the October estimate, more than a percentage point higher than the national rate and the highest for the state in almost 24 years.

In human terms, the state report showed, there were 105,300 unemployed this October. That compares with just 66,300 a year ago in the state.

"Nevada's unemployment rate is up significantly from a revised 7.2 percent in September and stands 2.5 percentage points higher than a year ago," said Bill Anderson, chief economist for the state Department of Employment, Training and Rehabilitation.

The actual October rate was pegged at 7.4 percent, according to the DETR report, but the headline rate of 7.6 percent is what the department calls seasonally adjusted. The department said the rate is the highest since May, 1985.

Las Vegas and Reno-Sparks, the state's two metropolitan regions, registered 7.5 percent and 7.2 percent rates, respectively. In Carson City's metropolitan statistical area it was 7.4 percent.

"The unemployment numbers released today underscore the importance of the legislation we passed yesterday to extend unemployment benefits," said Senate Majority Leader Harry Reid.

"This is an important step to ensure families can put food on their tables, but more needs to be done to strengthen our economy," the Nevada Democrat added.

Local hardship, sharp relief

Las Vegans in need turn out by hundreds for food in tough times.

The line of hundreds of Las Vegas’ working poor stretched around Doolittle Park’s baseball field and into its outfield before looping back.

For five hours Monday, grandmothers stood with children and grandchildren, dads with sons — just about every manner of family you could find — each awaiting a turn to take home two boxes of food.

None needed an economics expert to tell them how bad.

Born and raised in Las Vegas, Angelitte Poole, 29, recently lost her job collecting on overdue loans.

It wasn’t that business was down. Just the opposite, in fact. Poole’s problem was that the more struggling people she had to hassle about paying their bills, the less she wanted to do it.

“I wasn’t hitting my quota of $500 a day,” said Poole, in line with her mom, Janice. “It just got kind of depressing. Now I want a job, but all these temp agencies want me to pay them before I even get a job.”

In the early afternoon, Poole was about 280th in line for the handouts. But organizers said more than 1,500 people took home donation boxes before the end of the day. The line started forming at 8 a.m. in front of Doolittle Community Center, at 1950 J St., two hours before distribution began.

And these were not homeless people, Robyn Williams, one of the organizers, noted, adding that people brought in verification of their income and birth certificates for their children.

“Somebody told me about it two weeks ago,” said James Williams, a 43-year-old father of one. “I’m new to here, new to Vegas, so this is really, really going to help out.”

James Williams transferred here six months ago to help his mother, then recently lost his job as a machine operator for a cup manufacturer that closed its local operation. He’s now living on unemployment compensation, which comes to $335 a week.

“Not that surprised,” Williams said when asked about all the people in line. “People need this. Money is very tight. My own unemployment’s about to run out.”

Monday’s event dwarfed a similar one two years ago, said Las Vegas City Councilman Ricki Barlow, who helped with the food distribution.

That previous time, “we were done in three hours,” he recalled.

A few miles away, Clark County Commissioner Lawrence Weekly was seeing the same kind of need, but in a different way.

At the Martin Luther King Community Resource Center, Weekly gave away 350 turkeys with trimmings Monday afternoon. A year ago, he had about 500 turkeys to give away.

This year, he had to turn away 200 people, he said.

“We were very fortunate in previous years, because we had lots more people who were willing to step up and help,” he said. “But with the economy, turkeys are more expensive and trying to raise funds isn’t as easy.”

The need is so enormous Three Square is on pace to give away 10 million pounds of food costing about five times what the organization had expected to spend this year.

Julie Murray, Three Square’s chief executive, said her organization’s $250,000 food budget was spent by late spring. It now expects to spend $1.3 million for food this year. Murray said fundraising will cover most of the additional expense.

Closing:

Several years ago I received quite a bit of ridicule for forecasting many of these issues - going against the grain of the ignorant, yet widely prevailing "Las Vegas is recession proof" goldilocks viewpoint, and up to ~ 18 months ago many "economic experts" were still in denial. Today however, the data is hard to refute - the Las Vegas economic condition is bad.

With that said, if you want to listen to and believe these same pundits who denied this downturn at every step of the way, and who now claim the local economy will rebound in mid-2009, be forewarned - it will not - though bad today, the Las Vegas economic condition will get far worse over the coming months and years.

Regards

Randy