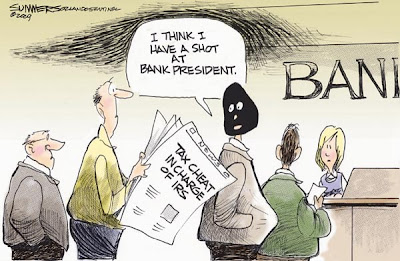

Consumer confidence in the U.S. sank to the lowest level on record in January as jobs evaporated and home values sank, signaling a further slide in spending at the start of 2009.

The Conference Board’s index, records for which go back to 1967, fell to 37.7, lower than forecast. A separate report showed the drop in house prices in major metropolitan areas deepened in November. The S&P/Case-Shiller 20-city index fell 18.2 percent from a year earlier, the most since it began in 2001.

Falling home values will worsen what’s already the biggest destruction of American household wealth ever recorded, and may make banks even more reluctant to offer mortgages. Federal Reserve officials gather today and tomorrow to consider fresh steps to shore up lending in an effort to halt the crisis.

“We’re in this sort of chain reaction phase of the downturn, where all the bad news is feeding on itself,” said Scott Brown, a senior economist at Raymond James & Associates Inc. in St. Petersburg, Florida, who forecast a reading of 37 for the confidence index. “Job losses lead to weaker consumer spending and that in turn leads to further job losses.”

State figures released today showed the unemployment rate jumped in all 50 U.S. states in December, underscoring the broad-based nature of the deterioration. Indiana and South Carolina led the country with a 1.1 percentage-point surge each in joblessness last month, the Labor Department said in Washington. Michigan had the highest rate, at 10.6 percent.

“The consumer is being squeezed on so many sides,” Douglas Smith, chief economist for the Americas at Standard Chartered Bank in New York, said in an interview with Bloomberg Television. “We’re going to have to see some turn in the labor market before we see much upside for consumer confidence.”

The S&P/Case-Shiller house-price report showed all the regions were down in the 12 months to November, led by a 33 percent slump in Phoenix and a 32 percent slide in Las Vegas.

A gauge of Americans’ view about the current economic environment dropped to 29.9 from 30.2. The Conference Board’s measure of the outlook for the next six months decreased to 43 from 44.2 in December.

Today’s report showed the share of consumers who said their incomes were likely to increase over the next six months fell to 10 percent, the lowest on record.

The U.S. recession, which began in December 2007, has so far cost 2.6 million jobs and is already the longest in a quarter century.

Bloomberg Link

Narrow escape: The Bank of England was forced to contact RBS's creditors abroad to persuade them not to withdraw their funds

Narrow escape: The Bank of England was forced to contact RBS's creditors abroad to persuade them not to withdraw their funds