Discussion of Housing Bubble, US Dollar, Debt, Trade Deficit, Oil, Gold, Consumer Spending, Central Banks, Inflation, Outsourcing and the Bleak Future of the US economy

This Blog and/or the articles contained within have been referenced, linked or quoted in: Businessweek online, WSJ Online, Dollar Collapse, Safehaven, Silverbear Cafe, Financial Armageddon, Yahoo & Google Finance -- among many other blogs & web-pages... Thanks for stopping in for a read!

Monday, February 27, 2006

January New Home Sales Tumble

Hmmm… This news kinda makes you want to sit back and think a little…

Let’s see… January housing starts were 2.276 million (per annum), equating to roughly 190,000 home starts. Today, news reports that January new home sales were down to 1.233 million (per annum), equating to roughly 103,000 home sales. It doesn’t take a rocket scientist (which I’m certainly not) to see that the US housing industry has just added 87,000 excess homes to the market in January 2006. These new homes (once finished) will add to the record number of homes already for sale nationwide (currently 528,000 total).

When you combine the housing information above with (1) The lowest personal savings rate since the Great Depression, (2) Consumer Bankruptcies at an all time high, (3) Increasing interest rate environment, (4) Rising Energy Costs and instability in world oil markets, (5) Continued US Outsourcing and loss of US job market, (6) Failing corporations--GM, Delphi, Ford, US airline industry, etc, (7) Increasing Trade Deficit and US Debt, (8) substantial US dollar problems, (9) Inverted Yield Curve, (10) complete lack of US Government interest in getting our economic house in order, and (11) $1 + Trillion dollars of Interest rate resets in the next 18 months, etc… what do you think will happen to the housing market and our economy? My thoughts: I believe it will be an American Wake Up Call

Anyway, based on the figures released today and the prevailing trend, it’s almost certain the US housing market will continue to cool. If it cools too fast, the abrupt economic fallout could be severe. If it cools slowly, it will be less painful, but any one of the other issues I listed above could create their own potential problems and economic fallout, thus adding to the misery.

Either way, our future doesn’t look nearly as bright as our past, and the housing ATM is going the way of the US government and consumer—completely broke.

This is a very interesting, yet scary time to be alive.

I’ve written other articles about these same issues, and you can read them here, here, here and here.

Sunday, February 26, 2006

The End of Dollar Hegemony

As the world continues to pay increasingly higher oil prices, cracks in the dollar will begin to appear... Our government officials are spending like mad men while the trade deficit balloons & debt bulges at the seams. Meanwhile, foreign central banks cringe as they see our Federal Reserve printing presses smoking from overuse, and ultimately they begin to realize they'll probably never be repaid.

IMHO, the US dollar’s days, as the world's reserve, is probably very limited. When will we see this happen? Your guess is as good as mine, but I believe it will be sooner (within 15 years) rather than later. With that said, I believe we will experience much economic and geopolitical turmoil before now and the end of this decade, but it will take many, many additional years for the world to transition to a new reserve.

My thoughts for those of you interested in how this relates to the housing bubble: The current US housing bubble is only the latest symptom of broken economic fundamentals and was created by “Easy Al”--through massive liquidity and the lowest interest rates in 40-years. If the dollar happens to collapse before the housing bubble lets out the majority of its excess, the “Bubble” will probably be relegated to a footnote in history, as a dollar collapse will bring the world to its knees. With that said, the roles may be reversed and it may be the housing bubble’s deflation that ultimately brings the demise of the dollar, as 90% of our growth in GDP (2001-05) was due to housing and consumer spending. When the bubble deflates, consumers will lose their "wealth effect" and will have no choice but to pullback on spending. This pullback will send our country into a recession (my prediction is 2007). A U.S. recession will negatively impact the world and we could see a dumping of the dollar (depending on Fed Policy).

Anyway, enough of my “short” summary on the dollar… If you’d like to read more thoughts on the dollar, see my Blog articles here, here, here, and here.

With that behind me, the main reason I’m writing about the dollar today is: Three people independently sent me the same link to one of the finest articles on the US dollar I’ve had the opportunity to read. The article was actually a speech given by Congressman Ron Paul of Texas, before the U.S. House of Representatives on Feb 15, 2006.

If you only read one thing today, I recommend it be this: The End of Dollar Hegemony.

A hundred years ago it was called “dollar diplomacy.” After World War II, and especially after the fall of the Soviet Union in 1989, that policy evolved into “dollar hegemony.” But after all these many years of great success, our dollar dominance is coming to an end.

It has been said, rightly, that he who holds the gold makes the rules. In earlier times it was readily accepted that fair and honest trade required an exchange for something of real value.

First it was simply barter of goods. Then it was discovered that gold held a universal attraction, and was a convenient substitute for more cumbersome barter transactions. Not only did gold facilitate exchange of goods and services, it served as a store of value for those who wanted to save for a rainy day.

Though money developed naturally in the marketplace, as governments grew in power they assumed monopoly control over money. Sometimes governments succeeded in guaranteeing the quality and purity of gold, but in time governments learned to outspend their revenues. New or higher taxes always incurred the disapproval of the people, so it wasn’t long before Kings and Caesars learned how to inflate their currencies by reducing the amount of gold in each coin-- always hoping their subjects wouldn’t discover the fraud. But the people always did, and they strenuously objected.

This helped pressure leaders to seek more gold by conquering other nations. The people became accustomed to living beyond their means, and enjoyed the circuses and bread. Financing extravagances by conquering foreign lands seemed a logical alternative to working harder and producing more. Besides, conquering nations not only brought home gold, they brought home slaves as well. Taxing the people in conquered territories also provided an incentive to build empires. This system of government worked well for a while, but the moral decline of the people led to an unwillingness to produce for themselves. There was a limit to the number of countries that could be sacked for their wealth, and this always brought empires to an end. When gold no longer could be obtained, their military might crumbled. In those days those who held the gold truly wrote the rules and lived well.

That general rule has held fast throughout the ages. When gold was used, and the rules protected honest commerce, productive nations thrived. Whenever wealthy nations-- those with powerful armies and gold-- strived only for empire and easy fortunes to support welfare at home, those nations failed.

Today the principles are the same, but the process is quite different. Gold no longer is the currency of the realm; paper is. The truth now is: “He who prints the money makes the rules”-- at least for the time being. Although gold is not used, the goals are the same: compel foreign countries to produce and subsidize the country with military superiority and control over the monetary printing presses.

Since printing paper money is nothing short of counterfeiting, the issuer of the international currency must always be the country with the military might to guarantee control over the system. This magnificent scheme seems the perfect system for obtaining perpetual wealth for the country that issues the de facto world currency. The one problem, however, is that such a system destroys the character of the counterfeiting nation’s people-- just as was the case when gold was the currency and it was obtained by conquering other nations. And this destroys the incentive to save and produce, while encouraging debt and runaway welfare.

The pressure at home to inflate the currency comes from the corporate welfare recipients, as well as those who demand handouts as compensation for their needs and perceived injuries by others. In both cases personal responsibility for one’s actions is rejected.

When paper money is rejected, or when gold runs out, wealth and political stability are lost. The country then must go from living beyond its means to living beneath its means, until the economic and political systems adjust to the new rules-- rules no longer written by those who ran the now defunct printing press.

“Dollar Diplomacy,” a policy instituted by William Howard Taft and his Secretary of State Philander C. Knox, was designed to enhance U.S. commercial investments in Latin America and the Far East. McKinley concocted a war against Spain in 1898, and (Teddy) Roosevelt’s corollary to the Monroe Doctrine preceded Taft’s aggressive approach to using the U.S. dollar and diplomatic influence to secure U.S. investments abroad. This earned the popular title of “Dollar Diplomacy.” The significance of Roosevelt’s change was that our intervention now could be justified by the mere “appearance” that a country of interest to us was politically or fiscally vulnerable to European control. Not only did we claim a right, but even an official U.S. government “obligation” to protect our commercial interests from Europeans.

This new policy came on the heels of the “gunboat” diplomacy of the late 19th century, and it meant we could buy influence before resorting to the threat of force. By the time the “dollar diplomacy” of William Howard Taft was clearly articulated, the seeds of American empire were planted. And they were destined to grow in the fertile political soil of a country that lost its love and respect for the republic bequeathed to us by the authors of the Constitution. And indeed they did. It wasn’t too long before dollar “diplomacy” became dollar “hegemony” in the second half of the 20th century.

This transition only could have occurred with a dramatic change in monetary policy and the nature of the dollar itself.

Congress created the Federal Reserve System in 1913. Between then and 1971 the principle of sound money was systematically undermined. Between 1913 and 1971, the Federal Reserve found it much easier to expand the money supply at will for financing war or manipulating the economy with little resistance from Congress-- while benefiting the special interests that influence government.

Dollar dominance got a huge boost after World War II. We were spared the destruction that so many other nations suffered, and our coffers were filled with the world’s gold. But the world chose not to return to the discipline of the gold standard, and the politicians applauded. Printing money to pay the bills was a lot more popular than taxing or restraining unnecessary spending. In spite of the short-term benefits, imbalances were institutionalized for decades to come.

The 1944 Bretton Woods agreement solidified the dollar as the preeminent world reserve currency, replacing the British pound. Due to our political and military muscle, and because we had a huge amount of physical gold, the world readily accepted our dollar (defined as 1/35th of an ounce of gold) as the world’s reserve currency. The dollar was said to be “as good as gold,” and convertible to all foreign central banks at that rate. For American citizens, however, it remained illegal to own. This was a gold-exchange standard that from inception was doomed to fail.

The U.S. did exactly what many predicted she would do. She printed more dollars for which there was no gold backing. But the world was content to accept those dollars for more than 25 years with little question-- until the French and others in the late 1960s demanded we fulfill our promise to pay one ounce of gold for each $35 they delivered to the U.S. Treasury. This resulted in a huge gold drain that brought an end to a very poorly devised pseudo-gold standard.

It all ended on August 15, 1971, when Nixon closed the gold window and refused to pay out any of our remaining 280 million ounces of gold. In essence, we declared our insolvency and everyone recognized some other monetary system had to be devised in order to bring stability to the markets.

Amazingly, a new system was devised which allowed the U.S. to operate the printing presses for the world reserve currency with no restraints placed on it-- not even a pretense of gold convertibility, none whatsoever! Though the new policy was even more deeply flawed, it nevertheless opened the door for dollar hegemony to spread.

Realizing the world was embarking on something new and mind boggling, elite money managers, with especially strong support from U.S. authorities, struck an agreement with OPEC to price oil in U.S. dollars exclusively for all worldwide transactions. This gave the dollar a special place among world currencies and in essence “backed” the dollar with oil. In return, the U.S. promised to protect the various oil-rich kingdoms in the Persian Gulf against threat of invasion or domestic coup. This arrangement helped ignite the radical Islamic movement among those who resented our influence in the region. The arrangement gave the dollar artificial strength, with tremendous financial benefits for the United States. It allowed us to export our monetary inflation by buying oil and other goods at a great discount as dollar influence flourished.

This post-Bretton Woods system was much more fragile than the system that existed between 1945 and 1971. Though the dollar/oil arrangement was helpful, it was not nearly as stable as the pseudo gold standard under Bretton Woods. It certainly was less stable than the gold standard of the late 19th century.

During the 1970s the dollar nearly collapsed, as oil prices surged and gold skyrocketed to $800 an ounce. By 1979 interest rates of 21% were required to rescue the system. The pressure on the dollar in the 1970s, in spite of the benefits accrued to it, reflected reckless budget deficits and monetary inflation during the 1960s. The markets were not fooled by LBJ’s claim that we could afford both “guns and butter.”

Once again the dollar was rescued, and this ushered in the age of true dollar hegemony lasting from the early 1980s to the present. With tremendous cooperation coming from the central banks and international commercial banks, the dollar was accepted as if it were gold.

Fed Chair Alan Greenspan, on several occasions before the House Banking Committee, answered my challenges to him about his previously held favorable views on gold by claiming that he and other central bankers had gotten paper money-- i.e. the dollar system-- to respond as if it were gold. Each time I strongly disagreed, and pointed out that if they had achieved such a feat they would have defied centuries of economic history regarding the need for money to be something of real value. He smugly and confidently concurred with this.

In recent years central banks and various financial institutions, all with vested interests in maintaining a workable fiat dollar standard, were not secretive about selling and loaning large amounts of gold to the market even while decreasing gold prices raised serious questions about the wisdom of such a policy. They never admitted to gold price fixing, but the evidence is abundant that they believed if the gold price fell it would convey a sense of confidence to the market, confidence that they indeed had achieved amazing success in turning paper into gold.

Increasing gold prices historically are viewed as an indicator of distrust in paper currency. This recent effort was not a whole lot different than the U.S. Treasury selling gold at $35 an ounce in the 1960s, in an attempt to convince the world the dollar was sound and as good as gold. Even during the Depression, one of Roosevelt’s first acts was to remove free market gold pricing as an indication of a flawed monetary system by making it illegal for American citizens to own gold. Economic law eventually limited that effort, as it did in the early 1970s when our Treasury and the IMF tried to fix the price of gold by dumping tons into the market to dampen the enthusiasm of those seeking a safe haven for a falling dollar after gold ownership was re-legalized.

Once again the effort between 1980 and 2000 to fool the market as to the true value of the dollar proved unsuccessful. In the past 5 years the dollar has been devalued in terms of gold by more than 50%. You just can’t fool all the people all the time, even with the power of the mighty printing press and money creating system of the Federal Reserve.

Even with all the shortcomings of the fiat monetary system, dollar influence thrived. The results seemed beneficial, but gross distortions built into the system remained. And true to form, Washington politicians are only too anxious to solve the problems cropping up with window dressing, while failing to understand and deal with the underlying flawed policy. Protectionism, fixing exchange rates, punitive tariffs, politically motivated sanctions, corporate subsidies, international trade management, price controls, interest rate and wage controls, super-nationalist sentiments, threats of force, and even war are resorted to—all to solve the problems artificially created by deeply flawed monetary and economic systems.

In the short run, the issuer of a fiat reserve currency can accrue great economic benefits. In the long run, it poses a threat to the country issuing the world currency. In this case that’s the United States. As long as foreign countries take our dollars in return for real goods, we come out ahead. This is a benefit many in Congress fail to recognize, as they bash China for maintaining a positive trade balance with us. But this leads to a loss of manufacturing jobs to overseas markets, as we become more dependent on others and less self-sufficient. Foreign countries accumulate our dollars due to their high savings rates, and graciously loan them back to us at low interest rates to finance our excessive consumption.

It sounds like a great deal for everyone, except the time will come when our dollars-- due to their depreciation-- will be received less enthusiastically or even be rejected by foreign countries. That could create a whole new ballgame and force us to pay a price for living beyond our means and our production. The shift in sentiment regarding the dollar has already started, but the worst is yet to come.

The agreement with OPEC in the 1970s to price oil in dollars has provided tremendous artificial strength to the dollar as the preeminent reserve currency. This has created a universal demand for the dollar, and soaks up the huge number of new dollars generated each year. Last year alone M3 increased over $700 billion.

The artificial demand for our dollar, along with our military might, places us in the unique position to “rule” the world without productive work or savings, and without limits on consumer spending or deficits. The problem is, it can’t last.

Price inflation is raising its ugly head, and the NASDAQ bubble-- generated by easy money-- has burst. The housing bubble likewise created is deflating. Gold prices have doubled, and federal spending is out of sight with zero political will to rein it in. The trade deficit last year was over $728 billion. A $2 trillion war is raging, and plans are being laid to expand the war into Iran and possibly Syria. The only restraining force will be the world’s rejection of the dollar. It’s bound to come and create conditions worse than 1979-1980, which required 21% interest rates to correct. But everything possible will be done to protect the dollar in the meantime. We have a shared interest with those who hold our dollars to keep the whole charade going.

Greenspan, in his first speech after leaving the Fed, said that gold prices were up because of concern about terrorism, and not because of monetary concerns or because he created too many dollars during his tenure. Gold has to be discredited and the dollar propped up. Even when the dollar comes under serious attack by market forces, the central banks and the IMF surely will do everything conceivable to soak up the dollars in hope of restoring stability. Eventually they will fail.

Most importantly, the dollar/oil relationship has to be maintained to keep the dollar as a preeminent currency. Any attack on this relationship will be forcefully challenged—as it already has been.

In November 2000 Saddam Hussein demanded Euros for his oil. His arrogance was a threat to the dollar; his lack of any military might was never a threat. At the first cabinet meeting with the new administration in 2001, as reported by Treasury Secretary Paul O’Neill, the major topic was how we would get rid of Saddam Hussein-- though there was no evidence whatsoever he posed a threat to us. This deep concern for Saddam Hussein surprised and shocked O’Neill.

It now is common knowledge that the immediate reaction of the administration after 9/11 revolved around how they could connect Saddam Hussein to the attacks, to justify an invasion and overthrow of his government. Even with no evidence of any connection to 9/11, or evidence of weapons of mass destruction, public and congressional support was generated through distortions and flat out misrepresentation of the facts to justify overthrowing Saddam Hussein.

There was no public talk of removing Saddam Hussein because of his attack on the integrity of the dollar as a reserve currency by selling oil in Euros. Many believe this was the real reason for our obsession with Iraq. I doubt it was the only reason, but it may well have played a significant role in our motivation to wage war. Within a very short period after the military victory, all Iraqi oil sales were carried out in dollars. The Euro was abandoned.

In 2001, Venezuela’s ambassador to Russia spoke of Venezuela switching to the Euro for all their oil sales. Within a year there was a coup attempt against Chavez, reportedly with assistance from our CIA.

After these attempts to nudge the Euro toward replacing the dollar as the world’s reserve currency were met with resistance, the sharp fall of the dollar against the Euro was reversed. These events may well have played a significant role in maintaining dollar dominance.

It’s become clear the U.S. administration was sympathetic to those who plotted the overthrow of Chavez, and was embarrassed by its failure. The fact that Chavez was democratically elected had little influence on which side we supported.

Now, a new attempt is being made against the petrodollar system. Iran, another member of the “axis of evil,” has announced her plans to initiate an oil bourse in March of this year. Guess what, the oil sales will be priced Euros, not dollars.

Most Americans forget how our policies have systematically and needlessly antagonized the Iranians over the years. In 1953 the CIA helped overthrow a democratically elected president, Mohammed Mossadeqh, and install the authoritarian Shah, who was friendly to the U.S. The Iranians were still fuming over this when the hostages were seized in 1979. Our alliance with Saddam Hussein in his invasion of Iran in the early 1980s did not help matters, and obviously did not do much for our relationship with Saddam Hussein. The administration announcement in 2001 that Iran was part of the axis of evil didn’t do much to improve the diplomatic relationship between our two countries. Recent threats over nuclear power, while ignoring the fact that they are surrounded by countries with nuclear weapons, doesn’t seem to register with those who continue to provoke Iran. With what most Muslims perceive as our war against Islam, and this recent history, there’s little wonder why Iran might choose to harm America by undermining the dollar. Iran, like Iraq, has zero capability to attack us. But that didn’t stop us from turning Saddam Hussein into a modern day Hitler ready to take over the world. Now Iran, especially since she’s made plans for pricing oil in Euros, has been on the receiving end of a propaganda war not unlike that waged against Iraq before our invasion.

It’s not likely that maintaining dollar supremacy was the only motivating factor for the war against Iraq, nor for agitating against Iran. Though the real reasons for going to war are complex, we now know the reasons given before the war started, like the presence of weapons of mass destruction and Saddam Hussein’s connection to 9/11, were false. The dollar’s importance is obvious, but this does not diminish the influence of the distinct plans laid out years ago by the neo-conservatives to remake the Middle East. Israel’s influence, as well as that of the Christian Zionists, likewise played a role in prosecuting this war. Protecting “our” oil supplies has influenced our Middle East policy for decades.

But the truth is that paying the bills for this aggressive intervention is impossible the old fashioned way, with more taxes, more savings, and more production by the American people. Much of the expense of the Persian Gulf War in 1991 was shouldered by many of our willing allies. That’s not so today. Now, more than ever, the dollar hegemony-- it’s dominance as the world reserve currency-- is required to finance our huge war expenditures. This $2 trillion never-ending war must be paid for, one way or another. Dollar hegemony provides the vehicle to do just that.

For the most part the true victims aren’t aware of how they pay the bills. The license to create money out of thin air allows the bills to be paid through price inflation. American citizens, as well as average citizens of Japan, China, and other countries suffer from price inflation, which represents the “tax” that pays the bills for our military adventures. That is until the fraud is discovered, and the foreign producers decide not to take dollars nor hold them very long in payment for their goods. Everything possible is done to prevent the fraud of the monetary system from being exposed to the masses who suffer from it. If oil markets replace dollars with Euros, it would in time curtail our ability to continue to print, without restraint, the world’s reserve currency.

It is an unbelievable benefit to us to import valuable goods and export depreciating dollars. The exporting countries have become addicted to our purchases for their economic growth. This dependency makes them allies in continuing the fraud, and their participation keeps the dollar’s value artificially high. If this system were workable long term, American citizens would never have to work again. We too could enjoy “bread and circuses” just as the Romans did, but their gold finally ran out and the inability of Rome to continue to plunder conquered nations brought an end to her empire.

The same thing will happen to us if we don’t change our ways. Though we don’t occupy foreign countries to directly plunder, we nevertheless have spread our troops across 130 nations of the world. Our intense effort to spread our power in the oil-rich Middle East is not a coincidence. But unlike the old days, we don’t declare direct ownership of the natural resources-- we just insist that we can buy what we want and pay for it with our paper money. Any country that challenges our authority does so at great risk.

Once again Congress has bought into the war propaganda against Iran, just as it did against Iraq. Arguments are now made for attacking Iran economically, and militarily if necessary. These arguments are all based on the same false reasons given for the ill-fated and costly occupation of Iraq.

Our whole economic system depends on continuing the current monetary arrangement, which means recycling the dollar is crucial. Currently, we borrow over $700 billion every year from our gracious benefactors, who work hard and take our paper for their goods. Then we borrow all the money we need to secure the empire (DOD budget $450 billion) plus more. The military might we enjoy becomes the “backing” of our currency. There are no other countries that can challenge our military superiority, and therefore they have little choice but to accept the dollars we declare are today’s “gold.” This is why countries that challenge the system-- like Iraq, Iran and Venezuela-- become targets of our plans for regime change.

Ironically, dollar superiority depends on our strong military, and our strong military depends on the dollar. As long as foreign recipients take our dollars for real goods and are willing to finance our extravagant consumption and militarism, the status quo will continue regardless of how huge our foreign debt and current account deficit become.

But real threats come from our political adversaries who are incapable of confronting us militarily, yet are not bashful about confronting us economically. That’s why we see the new challenge from Iran being taken so seriously. The urgent arguments about Iran posing a military threat to the security of the United States are no more plausible than the false charges levied against Iraq. Yet there is no effort to resist this march to confrontation by those who grandstand for political reasons against the Iraq war.It seems that the people and Congress are easily persuaded by the jingoism of the preemptive war promoters. It’s only after the cost in human life and dollars are tallied up that the people object to unwise militarism.

The strange thing is that the failure in Iraq is now apparent to a large majority of American people, yet they and Congress are acquiescing to the call for a needless and dangerous confrontation with Iran.

But then again, our failure to find Osama bin Laden and destroy his network did not dissuade us from taking on the Iraqis in a war totally unrelated to 9/11.

Concern for pricing oil only in dollars helps explain our willingness to drop everything and teach Saddam Hussein a lesson for his defiance in demanding Euros for oil.

And once again there’s this urgent call for sanctions and threats of force against Iran at the precise time Iran is opening a new oil exchange with all transactions in Euros.

Using force to compel people to accept money without real value can only work in the short run. It ultimately leads to economic dislocation, both domestic and international, and always ends with a price to be paid.

The economic law that honest exchange demands only things of real value as currency cannot be repealed. The chaos that one day will ensue from our 35-year experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or Euros. The sooner the better.

Saturday, February 25, 2006

Economic News

OIL

Yesterday a Suicide Attack on Saudi Arabia’s largest refinery caused Oil prices to jump $2.37 a barrel in one day of trading.

"It's new in the sense that this is the boldest attempt to strike at the heart of a Saudi oil- production complex," Antoine Halff, an oil analyst for Eurasia Group, said. "So far, they had been confined to office buildings and housing units."

Another article suggests this move "clearly signals that al-Qaeda is concentrating on oil, and not the government". Fimat analyst Mike Fitzpatrick said the Saudi incident added to jitters stemming from religious strife in Nigeria and concerns about Iraq and Iran. "Obviously, this has to heighten awareness of the increasing danger in that part of the world," he said.

Jim Lehrer NewsHour is reporting that Oil Supplies are Unstable and incorporates the perspectives of several smart folks.

VENEZUELA

In another move to create a rift between Hugo Chavez’s government and the US, Venezuela announced yesterday that it would prohibit Continental Airlines and Delta Air Lines from flying into their South American nation. They will also restrict flights by a third major U.S. carrier, American Airlines.

FANNIE MAE

Bloomberg is reporting that Fannie Mae Report Spotlights `Mind-Boggling' Accounting Errors.

``What do I have up my sleeve to solve an earnings shortfall?,'' Vice President of Financial Reporting Leanne Spencer asked Chief Financial Officer Timothy Howard.

The exchange was one of at least two deliberate attempts to fudge numbers to meet financial targets that led to $10.8 billion in accounting errors at the government-chartered company. The report concluded that Fannie Mae, which controlled assets exceeding $1 trillion, developed a culture that fostered misleading results and employed a staff ``unqualified'' to detect errors by top management.

BERNANKE

According to this new Bloomberg report, the Helicopter man will continue with “Easy Al” Greenspan’s policy of not targeting asset bubbles, and will continue the policy of “mopping-up” after a burst.

Feb. 24 (Bloomberg) -- Federal Reserve Chairman Ben S. Bernanke, staking out a key policy in his first month on the job, said it's a ``bad idea'' for the central bank to try to influence housing and stock prices through interest-rate moves.

``To use interest rates to try to puncture the housing bubble would be a disastrously bad idea, and Bernanke obviously agrees, because he's not going to come close to doing that,'' said Alan Blinder, a former Fed vice chairman who is now a Princeton economics professor. He wrote a paper last year saying Greenspan might have been the ``greatest central banker'' ever.

Blinder said the Greenspan-Bernanke approach to bubbles is ``basically, you do nothing, and then the corollary to that is that you mop up after they burst to keep the financial system from taking a big fall.'' Bernanke's hands-off approach has ``been his position for years, since he was an academic,'' Blinder said.

GENERAL MOTORS

GM has more problems on the horizon. TheStreet.com reported yesterday: The Local 755 branch of the International Union of Electrical Workers-Communications Workers of America voted unanimously to authorize a strike if a bankruptcy judge cancels its labor contracts, according to a report from the Associated Press that cited Local 755 Chairman Keith Bailey. Local 755 represents 1,050 workers at a Delphi suspension parts plant in Kettering, Ohio, the A.P. said.

If Delphi workers go on strike, GM could end up in a standstill, and unable to get parts, they will bleed cash, increasing likelihood of ultimate Bankruptcy.

IRAQ

Sectarian violence continues to escalate in IRAQ. Reuters is reporting that Iraq is warning risk of endless civil war:

Iraq's defence minister warned of the risk of an endless "civil war" as sectarian violence flared again on Saturday, killing over 40, and Sunni and Shi'ite leaders met to try to halt four days of bloodshed.

With the gravest crisis since the U.S. invasion threatening his plan to withdraw 136,000 troops, U.S. President George W. Bush made a round of calls to Iraqi leaders on all sides urging them to work together to break a round of attacks sparked by the suspected al Qaeda bombing of a Shi'ite shrine on Wednesday.

"If there is a civil war in this country it will never end," Defence Minister Saadoun al-Dulaimi said earlier as a traffic ban around the capital was extended to Monday following attacks on Sunni mosques and car bomb in a Shi'ite holy city.

UAE PORT DEAL

Looks like the Bush Administration is taking a hard-line stance and won't reconsider the U.A.E. port deal. However, The Department of Homeland Security initially objected to the agreement.

ECONOMIC INDICATORS

INFLATION IS REARING ITS UGLY HEAD. Consumer Price Inflation is up .7% in January, as January Durables Orders Fell 10.2%. Also of Note: the Chinese YUAN hit new highs as the US dollar tumbled, and Gold soared $10 to close the week up 1%.

BIRD FLU

The Bird Flu is circling the globe like wildfire and has now made it to France and Germany. Experts are now saying “even if the current pandemic killing birds passes, no one should breathe a sign of relief because the threat to people will not be gone.”

"At best, a containment policy will only postpone the emergence of a pandemic, 'buying time' to prepare for its effects," Dr Marc Lipsitch and colleagues from the Harvard School of Public Health and Dr Carl Bergstrom from the University of Washington wrote.

IRAN-USA

This article is well worth the time spent reading it, and states that (based on their research and analysis), our current situation with IRAN could turn into a complete financial crisis of a scope comparable with that of 1929.

IMHO, based on trends & analysis of current information, I honestly believe our country and economy are headed towards very tough times.

Wednesday, February 22, 2006

Commercial Real Estate Bubble?

Anyway, a hearty “thank you” to BusinessWeek for the plug, but I must admit that my feelings go against the general thoughts/comments in the article linking to me—“No Commercial Real Estate Bubble.”

Those who have taken the time to read my Blog will quickly understand that my philosophy takes into account numerous factors, and I feel the U.S. housing bubble is only the latest (albeit huge) symptom of much larger fundamental economic imbalances that will soon start to correct.

My belief is: Our U.S. Housing Bubble is the direct result of massive Fed liquidity, several years of ultra-low interest rates, relaxed lending standards, high use of non-conventional mortgages, general economic euphoria and irrational exuberance on the part of realtors, loan agents, speculators, new homeowners and the general public.

I also feel it was part of Alan Greenspan’s “Master Plan” to create a new asset bubble in an effort to help the U.S. get out of a recessionary period (post stock market crash and 9/11). In his endeavor to stimulate the economy, Mr. Greenspan swiftly opened the money spigots, and dropped interest rates to a 40-year low. Alan then blew more oxygen into the bubble by recommending the use of adjustable & non-conventional mortgages…the bubble grew.

Ultimately his plan worked, as housing prices rose, consumers spent like crazy (using their homes as ATM’s), construction permits soared, U.S. GDP grew, the Stock market re-inflated, and here we are today… dumb, fat, happy and completely oblivious to the huge economic problems at our doorstep.

If we take a casual look at our country’s economic situation today, everything looks real good on the surface, but strip back a couple of layers and things get real ugly, real quick:

- Our trade deficit is at an all time high—again! ($726B)

- Cumulative government debt is soaring ($8.25T)

- We have exceeded our congressionally authorized debt ceiling ($8.184T)

- Massive fed liquidity; M3 is greater than $10 Trillion dollars

- Foreign Central Banks own ~ $3 Trillion U.S. Debt

- Foreigners could dump their dollars/wreck our economy at will

- We Americans consume ~ 80% of world’s savings to maintain our lifestyle

- U.S. has massively outsourced blue/white collar jobs--continues to do so

- Consumer spending/housing were responsible for 90% of growth in GDP

- U.S. savings rates are negative--not seen since the great depression

- New day of increasing interest rates—possibly higher than predicted

- Lending practices will soon start to tighten up as risks increase

- Inflation is rising—probably much higher than gvt’s manipulated figures

- Housing market cooling--taking away consumer wealth effect/housing ATM

- Interest rates will reset on > $1 Trillion in mortgages in next 18 months

- Inverted Yield curve (possible recession on the horizon?)

- GM, FORD, DELPHI, US Airlines and many others are struggling

- Oil is currently a major issue (world supply/demand and higher prices)

- Numerous issues w/ IRAN, Venezuela and Nigeria

- Oil could rise to > $100 barrel this year and clobber the world economy

Bottom Line: Far too many negative issues at play here. Our United States is quickly turning into a service based, consumer nation and we, as Americans, are currently living far beyond our means. I honestly (yet regretfully) believe that we will be in a recession by this time next year (Feb 07), and by that time, it will become quite apparent that we have both a housing bubble and a commercial real estate bubble.

Let’s all hope we can get through this next recession intact... It'll be a monster this time!

Regards... Randy

Note: I've previously discussed many of these issues here--if you like to read more

Monday, February 20, 2006

Secret UAE Port Deal

Apparently, the $6.8 Billion agreement was made under the veil of numerous classified discussions, and our Homeland Security Secretary (Michael Chertoff) is actually defending the deal: "Without getting into classified information, what we typically do if there are concerns, is we build in certain conditions or requirements that the company has to agree to make sure we address the national security concerns," said Michael Chertoff. "And here, the Coast Guard and Customs and Border Protection really played a leading role for our department in terms of designing those conditions and making sure that they are obeyed."

Sen. Charles Schumer is one of the few who has denounced the deal, saying the UAE has "a sad history with terrorism." "Outsourcing the operations of our largest ports to a country with long involvement in terrorism is a homeland security accident waiting to happen," he said.

How can US government officials even think about allowing this agreement (the outsourcing of America at its finest) to happen?

Answer: I personally believe it has everything to do with Oil and the US Dollar. (Note: I’m not the sharpest knife in the drawer and this is just pure speculation).

In 1943 President Franklin D. Roosevelt developed a relationship with Saudi Arabia and made it official by shaking hands with King Sa'ud Bin-Abd-al-Aziz Al Sa'ud aboard the U.S.S. Quincy in the Suez Canal. Since that time, the US has been militarily involved in the Middle East, as the defense of the region is key to U.S. interests.

In 1973 a new term was coined (the Petrodollar) to describe the situation that was occurring in OPEC countries. Any country that needed oil first had to convert their currency to Dollars to buy the product. The Dollars accumulated by OPEC through the sale of their oil then allowed them to invest in the economies of the nations which purchased their oil.

Bottom line: worldwide oil sales are now denominated in U.S. dollars and these dollar holdings are rapidly increasing.

Skip to today: The world currently has > 10 Trillion dollars circling the globe (thanks to the Fed’s money machine), the number of petrodollars is also at an all-time high and oil producing countries (with huge bankrolls of cash) now need to a place to spend them.

The US government knows it is in a pickle. Far too many dollars are in the hands of foreign entities and the US dollar, as the world’s reserve, could be at stake if the US doesn’t allow them to spend some of these accumulated holdings. In an agreement to continue the US Petrodollar Ponzi scheme, our elected government officials have probably performed a quid-pro-quo with Dubai.

What are your thoughts on the situation?

Sunday, February 19, 2006

WHY US FED HIKES UNSPOKEN

The article is a long read, but I don’t think you’ll be disappointed… Please read on.

Preface: Welcome, Chairman Bernanke. May you ward off price inflation from reaching the core CPI. May you enact policies that continue to export inflation to Asia. Embrace those faulty statistics. You make me laugh with your explanation of the inverted Treasury yield curve. Your reason #1 of reduced inflation expectations and stable economy is self-serving, but it ignores the monstrous influence of outsourcing on job creation and cancerous transformation to a consumption economy centered on malls and retail chains, filled by omnipresent cheap imported products. Your reason #2 of a prevalent global savings glut ignores identification of the $700 billion trade deficit imbalance as a problem. You tell us as clearly as you can that the USFed will continue rate hikes. Your solution for the massive trade gap and current account deficit is to improve savings in the United States, lift spending in foreign economies, and make more flexible the currency exchange rates. How incredibly shallow for a central banker!!! A college student with an introductory economics course under his or her belt could recite such a trivial solution. How about another shallow solution: import less and export more, which the public will understand better???

The US Federal Reserve has several motives to continue in its interest rate tightening cycle. However, we have entered the hidden agenda realm. The Greenspan Fed might have delivered on more transparency, but the institution surely holds dear its hidden motives, secret objectives, replete with clandestine activity. Someday their convenient partnerships will be better known. The best way to be safe is not to discuss them, but rather to be aware of their existence, and to anticipate the effect of their activity. Generally, one can confidently claim that the USFed is no better, no worse, than the lying thieves who deceive and line their own pockets on Wall Street. The umbilical cord connecting Wall Street to the USFed is the giant banks, who have large brokerage arms under their corporate umbrellas, permitted since the repeal of the Glass Steagall Act. Since 1999, big banks, brokerage houses, and insurance firms have been permitted to work together, sleep together, share agendas together, deceive together, profit together, and perhaps someday go down together. Such is the pathogenesis of the cancerous encroachment which contradicts the supposed independence of the central bank. Enough, the USFed will hike rates more. They don’t need to offer a reason to justify their actions. However, if the financial markets (stocks, bonds, currencys) are to retain confidence in the US$-based systems, our central bank must give reasons, even if those reasons are pure fiction and full of the same lard tossed onto the masses during these heyday chapters written on economic mythology.

STATED OFFICIAL REASONS

The USFed actually states they can afford the luxury of additional interest rate hikes because the USEconomy is robust and strong. It is amazingly resilient, provided a convenient bubble can be inflated in a major sector within that economy. An exaggerated growth rate and rising inflation pressures (housing, CPI, employment costs) are the spoken motives for further 25 basis point increases. They speak of a tight labor market, one where the jobless rate ignores all those who cannot find work or collect unemployment insurance. They talk about “full employment” of 4.9% jobless amidst rampant unemployment. Include the jobless and we see a 7.4% jobless rate.

The USFed cannot be honest, since its credibility would be shattered. Go figure. They must defend their position of strength, and continue to describe the USEconomy as strong. They must maintain the notion that their monetary policy has managed to keep the economy robust, healthy, balanced, flexible, and full of vitality. And yes, expert monetary policy under the near perfect aegis of Alan Greenspan has enabled the USEconomy to avert a recession since 1990. What is the best device to avoid a recession in the world of public reality? Basically, FRAUD & LIES.

The puny Q4 GDP came in officially at 1.1% growth. Subtract the 4% to 5% from fraud, lies, deception, as price inflation (removed from sleight of hand from the formulas) is put back into the indexes, and we see a minus 3% Gross Domestic Product, maybe worse. The negative growth confirms the US Treasury yield curve, which has become inverted or at least very flat indeed. Recession always confirms the reliable inverted yield curve signal. Another confirmation is the growing crude oil inventories, and its flagging price, which yesterday fell below $60 per barrel. Another confirmation is the growing list of home builders who warn. Another confirmation is the long list of big name companies who have warned on future performance.

There is reality behind the rising Consumer Price Index, the rising Employment Cost Index, and the extended housing bubble. Over 2005, the CPI rose 3.4%, the ECI rose 3.0%, and housing rose and rose and rose. Not to be left out, energy rose 17.1% in very visible fashion. It is a strange directive whose drumbeat the USFed seems to march to. They desire a halt to the rising consumer prices and employment costs. To heck with the workers of America and their need for higher wages! Let them eat cake! Wages have struggled mightily from Asian competition. Let wages rise, for God’s sake! Adjusted for inflation, real wages fell by 3.1% last year, and that means they fell much farther since adjustment for inflation is a total joke. My view is that the USFed hacks want to halt the rise in energy costs and housing prices on the domestic front. The crude oil price is cantilevered in opposition to the USDollar. Keep down the oil price, and therein support the USDollar.

The housing upcoming pullback comes with warnings from the high-end with Toll Brothers, and from the affordable low-end KB Homes. Now that the housing market has slowed and entered a decline in several markets, the USFed has seen fit to push it downward more severely with rising adjustable mortgage rates. Chairman Greenspan had the unmitigated gall last summer to criticize homeowners who over-leveraged themselves, with harsh words something like “those who did not heed the signs of rising rates were desirous of losses.” How cold, especially in view of the fact that Greenspan himself urged the long bond yield down in 2002 in order to rescue the USEconomy with his housing bubble weapon. He needed a new bubble to fight the effects of the last bubble. They in effect created a monster with housing, that monster is in dire fatigue, and the zookeeper has seen fit to deny it food as it staggers on its four feet. In tow, the monster has dragged along the retail consumption insanity. Heck, let’s cut that off at the knees also. It is painfully clear that there is no solution to the USEconomic woes.

THE UNSPOKEN REASONS

The US Federal Reserve cannot discuss the real problem, since that would alert the world to our gaping shortcomings, our giant warts, our horrid financial odor. The stench of spinning credit gears and rotting debt on the vines is acrid and shocking. They cannot expose or highlight the crippled dependence upon inflated asset bubbles (or their reversal), nor the revolt underway by those foreign central banks who feel betrayed, nay drowning in a sea of USDollar liquidity.

The unspoken motives for continued USFed rate hikes are several:

to counter and defend against a rising gold price

to counter and defend against a rising crude oil price

to encourage Asian exporters and Persian Gulf oil producers to recycle surpluses

to deter Asians and Persian Gulfers from diversification in their reserves

Continued USFed rate hikes to excess come with ulterior motives, without any doubt in my mind. Their effect will be to prevent a serious decline in the USDollar with mixed competing reactions to gold, sure to add to its volatility. Their unspoken motive is USDollar defense.

What can be stated publicly amidst political circles and before the financial community must be acceptable and harmless, even promising and constructive. Nevertheless, reality comes with a harsher face, with flaws, blemishes, weaknesses, and vulnerabilities exposed. The four above reasons cannot be stressed or discussed with too much detailed depth or conviction. Such is the province of professional analysts and independent newsletter writers, us independent blokes!

GOLDEN & OILY LINKS

Gold still competes with the USDollar. Another leap in the gold price might undercut the US$ noticeably and thereby threaten US Treasury bonds generally. The Petro-Dollar system in place contains mammoth cantilevered derivative positions with the US$ and crude oil in opposition. Another leap in the oil price would undercut the US$ more noticeably. Only a stable US$ can encourage incremental investment of surplus reserves in US Treasurys, US Mortgage Bonds, and S&P baskets. Only a stable US$ can encourage continued holding by foreigners in astronomical bond securities with steady diversification out of them. Behind the scenes, foreign central banks urge the USFed to continue to tighten as much as possible without harming US consumers, who are critical to those foreign economies so dependent upon export markets.

The interplay of various effects is difficult to gauge and predict. At this point, each official rate hike by the Fed will support the USDollar. More important is the perceived motive for the hike. If from a validly strong USEconomy in a non-inflationary climate, then the impact will be to cool the gold price. If from an intention to calm the housing boom, then the impact will be to cool off housing, but also to suppress the USEconomy and do great harm down the road when housing serves as a huge drag on it. If a housing bear market enters the living room, the effect on the USDollar will be enormous and negative, somewhat helpful for gold, less beneficial for crude oil. If from rising price inflation and employment costs, then the impact will be to light a fire under the gold price and fuel its rise. If from a defensive posture against gold, then attention is turned to gold, which only poses more questions. If to defend against crude oil, then it will not only keep the oil price down but also suppress and do harm to the USEconomy. If to keep our foreign credit suppliers to hold open the spigot flowing to feed our vast credit appetite and finance our debts, then it will succeed as long as the impact is effective in supporting the USDollar. Two undeniable factors are at work. The markets sense rising price inflation in many sectors, from housing to commodities to worker costs, and yes, to almost everything to run a business or a household. Foreign central banks are highly motivated to shed their US$-based holdings, at first at the margin of new purchases and later at the core of reserves.

FOREIGN RESERVES HELD OVERSEAS

See strange locations for purchases of Treasury Bonds to offset the near total stoppage of Asian USTBond support since July 2005, from the official USGovt TIC Report on foreign holdings data. Financial news media channels have dropped the ball. Japanese holdings have actually fallen since Aug2005. Chinese holdings have risen only slightly up to Dec2005, but with only minor increases in certain months.

Note the giant drop from the Caribbean last summer, offset by the giant rise from England. Big changes surfaced in the wake of the General Motors debt downgrade last summer, actually June2005. The unwind of credit default swaps brought about sales of those swaps and repurchases of US Treasury Bonds held as the spread anchor. The GM debt imploded, which lifted in value the debt insurance contracts linked to the swaps. As profit was taken in the swaps, investors gathered profits, but in doing so, they bought back their “shorted” TBond basis as anchor on the leveraged trades. Do the detective work and find roots of the swaps in hedge funds. Observe Aug2005 and the severe decline in USTBonds accounted for (end of swap trades, closed out) in the Caribbean. Observe Aug2005 and the severe decline in USTBonds account for in England. Did hedge fund money return home to London, only to be invested once more before Jan2005 ended? Methinks YES. Also, most experts believe illicit USFed shell agencies operate as tools out of the Caribbean banks. Heck, if it is good for the goose (mafia), it must be good for the gander also (USFed). Let’s just hope that (unlike the M3 money supply), these data sources remain publicly available, so that detectives among us can track these rogue devils with far less requisite skill than that possessed by Sherlock Holmes.

We might need more GM or Ford debt disasters in the near future. Unwind of additional profitable leveraged swap trades could come to the aid of the USTBonds once more. Any move above 4.6% in the 10-yr TNote yield (TNX) could, on a technical chart basis, motivate a giant move toward the 5.5% level. My conjecture is that the GM and Ford “events” have ended for some time, perhaps another several months. Besides, the USFed might desire higher long-term rates in the TNX. A higher TNX would relieve the troublesome signal emitted by an inverted Treasury yield curve. This enigmatic topic is discussed in the February Hat Trick Letter issue. Furthermore, a signal has been identified for subscribers to foretell whether the Treasury yield curve will steepen or invert further. One should be very clear about the so-called conundrum. The recession evidence seen in the Q4 quarter confirms the inverted yield curve. There is no conundrum. Instead off admitting their lie in the GDP, they label it a conundrum, as Greenspan rides into the sunset (mounted backwards on his bull). What a charlatan, a pied piper!

Leave address of the thorny topic, USFed monetization of USTBonds for another day. Its evidence is not so easy to track, without clear footprints and fingerprints. Or is it grease stains from the overworked printing presses?

COMMENT ON ETF FUNDS

While busy with the pen, a comment is in order about Exchange Traded Funds. The gold ETF is being proved to be a sham, not convincingly so, but enough to anyone harboring a suspicious mind. Stories abound within ETF’s regarding shorting gold via futures, buying 10 cents worth of gold per dollar held, lack of transparency, unaccountability under the false guise of security concerns, and avoidance of SEC requirements enough to earn a formal investigation. Eventually, we will learn that on a good day, a fractionally managed gold ETF is right on target with their reality. My uglier view is that ETF’s will morph into non-producing hedge firms, simple queer adjunct skeletal illicitly controlled shams linked to the hedged mining firms themselves, whose certificates are fully mixed, those valid vaulted very real with those leased vanished never to be seen again. For smart people to trust the ETF offerings is evidence of utter complete stupidity in my book. Jim Turk’s original suspicions might have been met with calls of competitive bias, but no more. His concerns have all been borne out as authentic. He is a true gold patriot. For the precious metal community to embrace the upcoming silver ETF is beyond my comprehension.

Such trust reminds me of the Iraq War and calls of weapons of mass destruction. Now Iran is a nuclear threat. Have we learned anything about disinformation? How intelligent is the gold community? Don’t confuse zeal and stubbornness for intelligence and craft. If Fanny Mae launched an ETF for housing investors, would we trust it? A credible argument can be made that the hedged gold institutions (within the establishment of the goomba World Gold Council to manage the gold ETF) is akin to the mafia managing the lending operations for the Teamster’s Union retirement fund. How is that working out? The streetTRACKS gold ETF (GLD) will have a similar fate someday, in managed receivership by some official steward.

LEADERSHIP & COMPETITIVENESS

The Bernanke baton handoff makes me ponder on leadership. Personally, I fear for America’s future. Our investment & brokerage system successfully integrated an umbilical cord to the US Federal Reserve and banking system. Was that the last fateful act and deed by Bill Clinton and Robert Rubin??? Our nation is unprepared either to lead itself or to detect the most basic deception by leaders. My disappointment and lost respect is turning to anger and ridicule. Here is my perception of future leaders of America.

American science and math skills are in a woeful state. Basic arithmetic with percentages might be a major challenge, let alone geometry. If anyone wants an outline of the proof to the Pythagorean Theorem (hypotenuse sum of squares rule), just email me. Got some down time after posting my February Hat Trick Letter issue this past weekend. Few analysts realize that the US is suffering the bitter fruit of 30 years of monetary inflation, which has lifted the US wage scale an order of magnitude higher than Asia to an uncompetitive pay scale. Concurrently, our population of skilled workers declines annually. The output of engineers from US institutions of higher learning in 2005 was 70 thousand, versus 200k in India and 500k in China. As Jimmy Rogers suggests, when your kid must choose a language in school, urge Chinese as the choice. Trouble is, US schools begin with foreign languages at age 15 typically, another failed policy. Try half that age in Europe and Asia. Not one in ten people of my acquaintance can recall any foreign language learned long ago. Lack of language skills goes hand in hand with ignorance at a cultural level, key to international diplomacy. Diplomatic stumbles leave the USEconomy as seriously vulnerable and at a disadvantage. We seem to have replaced diplomatic skill with arrogance and displays of power. Our media explosion has been squandered by reality TV shows, worthless sitcoms, movie reruns, vitriolic polarized debate between the right & left, coverage of endless murder trials and reports of missing children or euthanasia. News is sorely missing in the media despite countless US cable channels. This nation is in bigtime trouble. Lastly, here is my quintessential image of American math skills. This person surely found it, a solution indeed.

THE HAT TRICK LETTER COMBINES MACRO ANALYSIS WITH INVESTMENTS.

From subscribers and readers:

“As an aside, I’ve been managing money for 15 years and have met a number of top minds from Wall Street and I can say that I consider your work exceptional. You’ve got a terrific way of knitting seemingly unrelated pieces of information into a clear, concise view of the big picture.” (Philip B in New York)

“My friend Karl and I think you are a ‘bright light’ just like Paul Revere guiding us through the ‘fog’ that is purposely created by Washington.”(Craig McC in California)

“Most financial writings of other analysts appear to be muddy and tricky, while yours are always straight forward, easy to understand, yet with amazing accuracy in major trend. In my opinion you are quite successful in educating readers to look at economic fundamentals and how things run.”(Mic AY in Hong Kong)

Saturday, February 18, 2006

Oil back on the Radar

Many new readers may wonder why this Blog is concerned with oil. Please allow me to summarize my feelings as to why I believe it is important: Oil is absolutely vital to our economy, and higher oil prices will drive inflation. This rising inflation will negatively impact the consumer, who is (as I’ve previously pointed out) completely broke. In return, broke consumers who can not take on the added impact of higher fuel costs and inflation can not afford new homes, will start pulling back on spending, and may possibly increase credit cards defaults, home mortgages delinquencies, etc. (Note: Consumer spending has been responsible for 70% of US GDP). As consumers pull back on spending and increase their rates of loan defaults, our economy will contract. When our economy contracts, companies start lying off workers, the stock market falls, people lose more money, etc. Corporate layoffs exacerbate the situation, as folks are unable to pay bills, etc. Bottom Line: Higher oil prices can set off a chain of economic events our country is unprepared for.

I’ve discussed some of these issues before and you can see this link for more info.

Anyway, with all that said, it look like the recent fall in oil prices (sub $60 barrel) is over. Several issues are back on the Radar and we will see oil prices begin to rise again very soon. The current issues:

NIGERIA

VENEZUELA

IRAN

In Nigeria, Militants have started to launch a new wave of attacks, have kidnapped 9 more Shell workers and forced Shell to shut down a facility responsible for 400,000 Barrels of oil a day.

Nigeria produces about 2.5 million barrels a day and further attacks could make Oil officials reevaluate their operations in the area

In Venezuela, currently responsible for 1.5 Million barrels of oil supply for the US, President Hugo Chavez recently warned that he could cut off oil exports to the United States if Washington goes "over the line" in attempts to destabilize his left-leaning government.

In Iran, the U.S. will likely be forced to decide whether to accept a nuclear-armed Iran, or to take out their nuclear facilities with air strikes… I expect the latter. If this happens, Iran will cease oil shipments and/or create a choke point in the Strait of Hormuz--eliminating oil deliveries from Saudi Arabia, Kuwait and Iraq as well.

Bottom Line: As I’ve stated before (in Time to Worry), with already strained oil supplies (a mere 1% difference between world oil demand and world oil production & supply capacity), any significant disruption in the markets could easily send oil rocketing above $100 barrel oil. This would cause gas to jolt above $4 a gallon, and create a massive drag on the US economy (certainly a major Recession, possibly a Depression). It would also put pressure on the US Dollar (as the worlds reserve currency), but we’ll save that one for another day.

Regards... Randy

Friday, February 17, 2006

Housing Report & Looming Bubble Collapse

Many economic optimists feel that yesterday’s report on January’s record number of housing starts was dirt kicked in the face of Housing Bubble theorists. I completely disagree with that position, and believe the news only exacerbates the coming Bubble collapse.

Recently, Toll Brothers CEO, Robert Toll, said that speculators are canceling their contracts and exiting the market, while prospective buyers, sensing a slowdown, are no longer eager to commit to homes with a long delivery lag time.

With the increasing number of canceled home orders, and a drop of new-home sales (as reported by KB, Toll Brothers, Ryland, and Standard Pacific home builders) what will happen to all these new homes once they are actually built and on the market? Answer: They will add to the already increasing inventories, and with increasing mortgage rates, fewer speculators and a cooling housing market, these homes will have a very difficult time finding new owners.

We are already starting to see builders engage in heavy discounting and promotional activity. According to Capuchinomics, a recent National Association of Homebuilders survey found that 64% of builders are offering incentives like free upgrades and/or reduced/zero closing costs; and 19% are cutting prices.

With all this said, recent congressional comments from Big Money Ben Bernanke (BMBB) suggest that he may raise rates well beyond what many had previously forecasted (1 more hike w/stop at 4.75%). This new info is certainly great news for the US dollar--which is the real “unspoken” reason for higher rates, but it’s terrible for the housing sector, as any further increase beyond the already assumed 4.75% stopping point will drive mortgage rates even higher, will further invert the yield curve (a telltale sign of looming recession), and will clobber roughly 7 million homeowners (holding > $1 Trillion in mortgages) when their interest-only ARM’s reset in the coming 12-18 months.

Add the issues above to the numerous other concerns that I have previously pointed out, (negative personal savings rates--not seen since the Great Depression, home delinquency notice increases, increases in credit card delinquencies, record bankruptcies, potential oil supply concerns, higher energy prices, higher inflation than that reported, completely oblivious consumers displaying irrational exuberance, etc), and I think we have a catastrophe waiting to happen.

Time will only tell, but I’m definitely not optimistic about the report.

What are your thoughts on the subject?

Tuesday, February 14, 2006

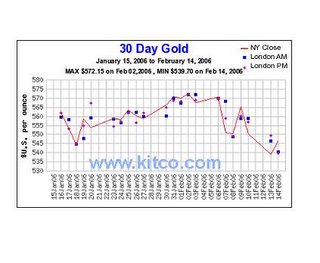

Gold’s Wild Ride

With that said, Gold is typically a long-term investment and the overall trend for gold is UP. Many suggest we should take these corrections as a time to increase positions, as these low prices may not be available for too long.

Numerous current issues are having an impact on the gold market: Gold prices are close to a 25 year high, Oil prices are lowering due to increasing inventories and the warmest winter on record; many Japanese investors are liquidating their long positions on the Tokyo exchange and the dollar is gaining strength on speculation of further Fed Rate increases (beyond the near guaranteed increase in March).

Bottom line: This wild ride is merely a “Shaking of the Branches” if you will, and the loose acorns are definitely falling. I hope this consolidation doesn’t spook you into taking any unnecessary losses. I believe the long-term trend is UP, UP, UP and will not personally allow this situation to spook me.

Regards... Randy

NOTE: This article is not to be taken as investment advice. It is merely my thoughts on the current gold market and is only being offered as food for thought…

Sunday, February 12, 2006

Economic sign of the times; what will our future hold?

Understanding these facts, what happens when consumer spending slows or the housing market cools off. Well, I believe we'll find out soon enough, as cracks are already beginning to appear in the economic façade.

Some of the issues coming to light:

Negative Consumer Savings

Credit Card Delinquencies

Personal Bankruptcies

Mortgage Delinquencies

Consumer Borrowing Slowdown

Home Loan Applications Fall

Rising Home Inventories

Inverted Yield Curve

Consumer Savings is at its lowest level since The Great Depression

Americans are spending everything they're making and more, pushing the national savings rate to the lowest point since the Great Depression.

The Commerce Department reported Monday that Americans' personal savings fell into negative territory at minus 0.5 percent last year. That means that people not only spent all of their after-tax income last year, but also had to dip into previous savings or increase borrowing.

The savings rate has been negative for an entire year only twice before — in 1932 and 1933 — two years when Americans had to deplete savings to cope with the massive job layoffs and business failures caused by the Great Depression.

Credit Card Delinquencies are At All-Time High (this occurred before minimum payments were doubled)

The American Banking Association reports that credit card delinquencies were at an all-time high in the second quarter of last year, which ended in June. The report showed that delinquencies were 4.81 percent. In the fall, delinquencies came down a bit to 4.74 percent. The ABA said that high interest rates and high gas prices have contributed to so many people falling behind. More delinquencies usually mean more bankruptcies.

Bankruptcies At All-Time High

Consumer Bankruptcies hit a new record in 2005—over two million people filed for bankruptcy--up 32% from 2004

2001: 1,452,030

2002: 1,539,111

2003: 1,625,208

2004: 1,552,967

2005: 2,043,535

Mortgage Delinquencies on the rise in California (a catalyst for Nation-wide trend?)

The number of default notices sent to the state's homeowners is up 15.6% in 2005's last quarter from a year earlier.

Lenders sent 14,999 default notices to California homeowners from October through December, according to DataQuick Information Systems. All areas of the state saw a rise in delinquency notices. The counties with the largest annual percentage increase in default notices were Napa, San Luis Obispo, San Francisco, Riverside, Orange and San Diego. The fourth-quarter total represents a 19% increase over the 12,606 notices sent out in the third quarter and a 15.6% hike over the 12,978 notices sent in the same period in 2004, the La Jolla-based firm said.

Consumer borrowing slows to a 13-year low

Consumers, weighed down by high debt loads and low savings rates, increased borrowing last year by the smallest amount in 13 years, the Federal Reserve reported Tuesday. The government said that borrowing on credit cards, auto loans and other forms of consumer debt rose by 3 percent in 2005, down from rates above 4 percent in the previous three years and a 7.7 percent surge in 2001. It was the smallest increase since a 1 percent rise in 1992.

Home Loan Applications Fall 2nd straight week

U.S. mortgage applications fell for a second consecutive week, led by a decline in home purchase loans, as interest rates hit their highest levels since early December, an industry trade group said on Wednesday.

Borrowing costs on 30-year fixed-rate mortgages, excluding fees, averaged 6.25 percent, up 0.05 percentage point from the previous week‘s 6.20 percent, marking their second consecutive weekly increase. Rates were at their highest levels since the week ended December 9, when they reached 6.28 percent.

Refinancings also decreased as a percentage of all mortgage applications, falling to 42.1 percent from 43 percent, the MBA said.

As mortgage rates started climbing in September, the market began to cool, and recent economic data has pointed to sustained slowing in the sector.

The U.S. housing market will cool this year as rising mortgage rates dampen home buyers‘ demand and lead to lower sales volume, smaller house price gains and a decline in construction, Freddie Mac (NYSE:FRE - news) Chief Economist Frank Nothaft said in an interview on Wednesday.

Home Inventories Rise as Housing Market Cools

With the key spring selling season about to get under way, the inventory of homes on the market is climbing sharply in a number of major cities.

It is the latest sign that the balance of power between buyers and sellers is shifting as the once red-hot housing market continues to cool. The slowdown is affecting both existing homes and new homes. Tuesday, the nation's largest builder of luxury homes, Toll Brothers Inc., reported a 29 percent decline in new orders in its first quarter, which ended Jan. 31. That was below many analysts' expectations and prompted a sharp sell off in Toll Brothers stock.

The Yield Curve has fully inverted

Historically an inverted yield curve has often signaled an economic recession six to 12 months after the yield curve has inverted, though many analysts are skeptical the current inversion is sending ominous signals.

SUMMARY:

I believe when we add up all these signs, they begin to tell us “all is NOT well”. If we then add in outsourcing, the loss of jobs at Ford, GM, Delphi and others, Union and Bankruptsy issues with the airline industry, our record Trade Deficit (just released), and the current predicament with IRAN and OIL, the picture gets even uglier.

I believe our economic house of cards is starting to show fundimental weakness and will soon begin to fall around us. Three years from now, when our economy is struggling, many will say “How could this happen?” “It was supposed to be different this time?” “Why didn’t we see this?”

What are your thoughts on the issue?

Friday, February 10, 2006

Our World Today

The New York Times is reporting that the United States trade deficit has widened to a record $726 billion in 2005:

Hitting its fourth consecutive annual record, the gap between exports and imports reached almost twice the level of 2001. It was driven by strong consumer demand for foreign goods and soaring energy prices that added tens of billions of dollars to the nation's bill for imported oil. The nation last had a trade surplus, of $12.4 billion, in 1975.

Many economists say this situation is unsustainable over the long run, arguing that the United States could eventually face a harsh correction that would depress spending, increase the cost of borrowing and sharply lower the value of the dollar.

Over all, the deficit jumped nearly 18 percent in 2005 compared with the previous year. Excluding oil and other petroleum products, the trade gap grew by 10 percent.

And with oil prices rising again, said Ashraf Laidi, chief currency analyst for the MG Financial Group in New York, "we can expect to see worse numbers to come."

NewKerala is reporting that the US Bond yield curve has fully inverted—A clear sign the US economy is headed for recession

Feb. 10: The U.S. bond market sent a powerful signal Friday that the nation's economy is headed for a recession.The interest rates payable on government debt securities typically are higher on longer-maturity securities, as a way to reward investors for letting the government have access to their money for a longer time period.But Friday afternoon the interest rates payable on government debt securities that mature from 6 months to 10 years exceeded the interest rates payable on 30-year government debt securities.

The Atlanta Constitution reports on U.S. debt and states there is no rescue from this fiscal quicksand:

Under the president's $2.77 trillion budget for fiscal 2007, federal expenditures would exceed revenue by $354 billion — a figure that includes $50 billion in costs for the wars in Iraq and Afghanistan — and leave unbroken the string of big budget deficits during the Bush administration, a troubling feat this deep into an economic expansion.

The red ink will push total federal debt to almost $9.3 trillion, increase the drag of interest payments and make it even more difficult to address long-term fiscal problems. Inevitably, the Bush policies will force consumer interest rates higher, putting home ownership out of the reach of many citizens.