I'd like to refer you to a very prophetic article written by Steven Lagavulin back in May 2004 (Mainpage:

deconsumption.typepad.com).

Steve's 2004 vision is absolutely amazing, and though his timeline has been off slightly, he has NAILED many of the events that have transpired through 2008. With such spot-on foresight (thus far), I think his outlook & viewpoints for the next decade should be seriously considered.

Main thoughts are: As we enter into a predicted depressionary period, we will deindustralize, deconsume, detach from the material world AND detox from mindless spending... Resources will become scarce, US Superpower status will be lost and WW III becomes quite possible. This depressed period will hone and temper our souls... Those that chose this as a test, and rise to the occasion will do just fine... those that are weak and cannot change will enter into the dustbin of history.

It is quite a long article and I've extracted the "meat" of it for you, but if you desire the full effect, please click on hyperlink below

Timeline for Unfolding Crisis of MankindRules of PredictionRule #1) The three principle factors to take into consideration in any prediction are the Force of the event being viewed, the Conditions external to it that can alter its propagation, and the length of Time outward which we are trying to foresee. This rule really only applies in generality, since it inherently shows that there are so many different variables affecting the totality of events proceeding in the world and their further influences on each other, that we can really only claim to view possible future outcomes in broad brushstrokes. It also shows that the ability to foresee the future necessarily only takes into question the particular field we have elected to consider.

Keeping this rule in mind, I will try to present this outline in broad brushstrokes, and ask the reader to remember that the items I’ve selected to represent the unfolding Crisis are simply my own subjective reference points. Also, I make no attempt to look further out than 10 years, and will be broadening the brushstrokes even that far out until hopefully, like a Master Brush-painter, I’ll be able to represent the essence of the thing with only a minimum of ink. And if that isn’t the case, then maybe try to think of it as a work by Jackson Pollack…

Rule #2) The tendency when making predictions is to accelerate the natural propagation of events, and to do so on even course. Experience shows that large-scale events tend to unfold “in fits and starts”: moving at what seems to be glacial speed, and then suddenly seeming to “erupt” when some extraneous event acts as a catalyst to precipitate them.

Rule #3) It’s not realistically possible to predict how the Power Possessing Beings of the world will react to influence events, but they will almost certainly do so adversely. It’s somewhat easier to foresee the reactions of a large group of people than those of a small group, since a greater number of entities serves to regulate and streamline the degree of choices that are available to individuals. And the chief reason why the future almost never unfolds “naturally”, and in the manner we foresee that it will is because powerful people are always trying to manipulate it. Thus government entities, corporate directors, religious leaders, etc are continually acting to try to shape the future in their image. It’s a perfectly human impulse, and rooted in the nature of our consciousness: if we have this unique capacity to foresee how cause and effect will unfold, then our response will usually be to try to alter conditions—to the degree that we're willing and able—in an attempt to achieve a more desirable outcome. We all do this at almost every moment of every day. People with power, however, can obviously accomplish things on a much larger scale. But at the same time their actions will always be directed by their own imperfect, subjective view of the world--and almost invariably a view of the world that helps them to achieve more money, more power and more control.

Possible Timeline for Unfolding of Crises (w/ a US-centric bias):Year 2004-2006At first the significant stressors to Mankind will be economic collapse, social unrest, and to a very limited extent, the first signs of difficulty coping with the transition to a life of hydrocarbon scarcity.

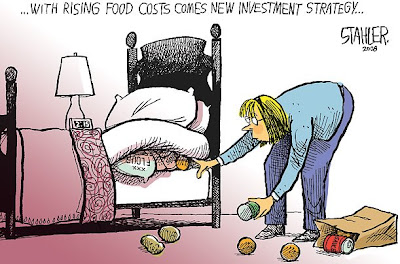

During this period, currency devaluation—especially in the US Dollar—will be the significant problem, along with the resulting inflation as prices of basic commodities rise (or more accurately, fluctuate wildly following a general rising direction). There may be a triggering event which causes a sharp downward movement in the price of the Dollar, or it may be a continuation of the slow, “controlled” devaluation we are seeing currently, but regardless, even that will eventually accelerate as the foreign holders begin to capitulate. Inflationary pressures will be further exacerbated by the rising costs of gasoline and fuel oil, and their residual price effect on transport and shipping, travel, and food production. This will not be a result of “Peak Oil” conditions—although this will likely rise up to become the “cause du jour” for American and European activists. Rather, higher oil prices will simply be reflecting the instability of conditions in oil-rich regions, and also the insistence by foreign suppliers for higher prices to offset the declining value of the US Dollar (which oil is currently priced in). In fact, toward the end of this period we can expect to see oil-rich countries demanding payment in Euros or even Gold. This will accelerate the fall of the Dollar if it has not already crashed prior to this event, since Dollars will no longer be necessary to settle trade in the world’s most important resource.

In the US, the Federal Reserve will find itself chasing two rabbits (and catching neither): trying to reverse the massive inflation they’ve created over the past couple decades while simultaneously raising interest rates. The will try to telegraph each rate move in hopes they can control the resulting bond market decline. Consumers, especially in the US, will begin to drastically rein in their spending as rising interest rates force them to confront their massive personal debts. Unemployment will continue to rise in the US and EU as companies struggle to control costs and pare back under the growing realization that their customers are tapped out. On the heels of these events, debt default on all levels (Government, Corporate, and Personal) will likely begin to become problematic for banks and finance companies, which will be forced to turn the screws a little bit on their debtors. We may even see the first hints from Congress or the Senate toward reforming or repealing personal bankruptcy laws. There might be a return to “union busting” as corporations become desperate to survive, and strikes may become commonplace.

Housing prices will begin to decline, especially in upscale suburbs, as interest rates are forced up and many people find they cannot support—or are even upside-down on—their mortgage loans. Downsizing will become attractive (or more likely, necessary) in the face of rising unemployment. However, modestly-priced houses—especially those in or near cities having a diverse economic core—should hold up well.

There will likely be the beginning of a shift in public opinion away from SUV’s and toward the newly “fashionable” hybrid cars (and possibly alternative fuel cars as well). Expect the Hummer to become a watershed symbol for the end of an era. Still, it’s unlikely that Americans will give up their SUV’s without a fight, so it’s possible that Hybrid-Hummers, Enviro-Escalades, etc will be slated by the Big 3 automakers in an attempt to put a mind-spin on the more legitimate fuel-efficiency movement. National energy conservation and fuel economy campaigns appear.

The rising cost of oil will take its toll initially on industries such as air and ground transport and intensive agriculture. We will undoubtedly see at least one more major airline go under, and possibly more, as the government will be extremely hard pressed to get any kind of bail-outs approved. The rising costs of nitrogenous fertilizer and diesel fuel will drive up food production prices—further aggravated by the increased fuel costs for transport. As such, non-corporate, local agriculture and meat producers will become more competitive.

Violent

civil unrest will begin to increase around the world as any number of angry, disenfranchised groups take their lessons from the Al-Queda handbook. The effectiveness of focused, persistent terror-strikes has grafted itself onto the world-view as a successful means for combating authority…or just simply sending a message. It’s possible the next terrorist attack on America will not involve foreigners….

The US-Mid-East War (nee War on Terror) is a major area of uncertainty because of the high probability for unexpected events. The US looks to be on track for repeating the mistakes of Vietnam, and public opinion is currently declining as the US is losing control of Iraq in many ways. The problem is that, unlike Vietnam, the US cannot simply “withdraw” as the region will quickly destabilize without their presence (thus cutting-off their control of the oil). The reinstatement of the Draft is already being bandied about, which might have flown if Gen-Xers were still of military age, but Boomers are not going to be eager to send their children off to Viet Nam II….especially when CNN has already shown them how un-romantic the defense of freedom really is over there. Still, a significant terror-event could serve to turn public opinion around, especially one on American soil…which is highly likely over this period of time. (Should such an event happen shortly before the November 2004 elections, however, it could backfire and become a public-relations time bomb for the current administration….). There is little doubt that Middle Eastern terrorist gangs are plotting attacks on American soil, and most likely the plans are of a sufficiently large scale to justify the effort. Most of these, however, will be poorly executed or thwarted altogether. Still, it’s likely that American society will have to suffer images of car-bombings at Pike Place Market in Seattle, or rockets fired into a major Las Vegas hotel, or some such.

One incident of high likelihood is that the rulership of the Saudi royal family will be overthrown or effectively compromised. This will severely weaken the US military position in the Middle East, and probably lead to a withdrawal of forces. In this event, oil prices would rise much more quickly and speed along most of the events in this Timeline.

World opinion of the US will probably continue to slide along with its economic and imperialistic fortunes. If President Bush is defeated for re-election this year, and his successor blames all problems on him and promises to redeem the American image, then there might be an opportunity to improve the country’s branding with the world. At least for a while. Any successor will find himself immediately caught up in the oil addiction issue, and with bad feelings in the Middle East and our troops already embedded there, it may seem awfully tempting to continue the Project for a New American Empire agenda. Meanwhile, Australia and Russia will be courting their Chinese neighbors, since that’s where their bread will be buttered. The same goes for the East Asian countries, including Japan.

2007-2010This is the period where life will begin to seem more uncertain, and “triggering events” will undoubtedly pop up in many spheres to propel mankind headlong into the future. Because the “tectonic plates” of human interaction will be sliding and grinding together in all directions, there is also a high likelihood for some type of new and unexpected “extraneous” crisis to erupt—one that could not even be imagined today.

The Western-centric concept of

“Globalization” will be fizzling fast as it becomes more costly to move resources around the globe. Money will be flowing fast out of the US looking for safe havens, and probably out of Western Europe as well. Asian currencies may become the beneficiaries of this, if their economies haven’t been stalled by the devaluation of their own massive dollar holdings, and the dwindling external markets for their products. But all currencies will be sliding, so perceived “strength” in any of them will be only relative. China will be hard-pressed to orchestrate a transition from an export economy to an import one, turning toward its own internal prosperity to provide a market for their goods. With massive overpopulation, it’s going to be almost impossible to sustain the kind of heated growth they’ve enjoyed for the past few years—without even mentioning the ravaging effects this growth is having on the environment worldwide. Critical pressures for food and oil there (China currently has no arable land left) will almost certainly turn Chinese aspirations northward toward Russia, with its overabundance of both—perhaps to forge friendly alliances…or perhaps not….

If not already underway, there is a high likelihood of a

derivatives crisis triggering global bankruptcy in the financial world during this period, probably initiating in the US mortgage industry. Governments will be unable to honor real or implied guarantees. This will effectively doom any hope that the Central Banks might be able to “manage” the economic and currency crises that have been unfolding. Bond rates will continue to soar, driving bankruptcy rates much higher, especially among residential and small business borrowers.

Worldwide, a void will begin to be felt by the beginning

decline of the US as a superpower. The signal for this won’t be hard to miss: China will “repatriate” Taiwan. Regional (or tribal) wars will spark up everywhere as both social distress and resource scarcity escalate. In South America, drug-cartels will almost certainly step up their terror-tactics against local authorities. Indian/Pakistani relations will probably breakdown become a global concern, for want of a more specific word…. The worst tragedies will occur in Africa, which will further become a basket-case of violence and disease.

China’s oil consumption will be outpacing any kind of conservation the US and Western Europe are struggling to achieve. Relations between these regions will almost certainly break down as they vie for control of remaining reserves. Much of this will obviously depend on developments in the US / Middle East conflict. If the US does not have direct control of Middle Eastern reserves, then it US will probably be on the short end of the negotiations, as Russia and the Middle East side with (or bow to) China in oil agreements. Poorer countries will be crushed by the cost of fossil fuel, and may become suicidally desperate (North Korea comes to mind…). The United Nations might possibly try to enact some type of import/export restrictions to help ease the strain on poorer countries. If World War III is in the cards for the Human race, we will probably see the

powers of the globe positioning themselves sometime around 2010.

The US might likely begin implementing “stabilizing” policies to control the price of oil during this period, and certainly we will see more energy conservation campaigns to address electricity and natural gas use. By now the whole economy will be suffering, but hard-hit industries during this period will include ground transport, petrochemical processing, mail and shipping dependent companies, the automotive industry, and tourism. On the brighter side, congestion may clear a bit in major cities as two-car families downsize, and the poor return to the “car-free” way of living they’ve traditionally enjoyed. (This applies primarily to the car-centric US, where the number of registered vehicles presently exceeds the number of registered drivers). If not already, expect to see legislation imposing some type of sin tax on gas-guzzlers (perhaps even singling out SUV’s) and corresponding subsidies on fuel-efficiency and alternative-fuel vehicles. Flying thousands of miles to lie on a beach will become a thing of the past for all but the wealthy. Only a couple airlines will survive bankruptcy through this period, and its likely that the government will be initiating emergency subsidies to keep them going. Small resorts within two or three hours of major metropolitan cities will experience increased business.

Sometime in this period the media may assert the belief that we are making real headway in correcting our oil crisis. This might be attributed to new investments in drilling and exploration triggered by the past few years of rising price-profits at energy firms, and which will be coming online during this period. Or there may be reports of large new reserve discoveries (probably invented, but no one will be able to verify them). It may also be touted that we have been offsetting consumption by adopting a kind of hodge-podge of alternative energy systems. Regardless, this feeling that perhaps all will be right with the world once again will be illusory and will not last long, since China/East Asia will continue to gobble up all the hydrocarbons that we are potentially pumping or saving—and out-negotiating us for import contracts.

Power outages in the US and Western Europe will become more problematic as the outdated transmission infrastructure begins to sag. Rising natural gas prices will take heating and electrical generation costs with them. Here again, energy rationing will be all the rage, as it was in the 1970’s. Photovoltaic systems (solar electricity panels) should finally achieve a roughly breakeven cost-effectiveness toward the end of this period, as technological advances combine forces with the rising costs (and unreliability) of getting electricity directly from the grid. Still, PV and Solar-Reflective generating plants will be slow to come online. Domestic PV systems will be most popular, but only the well-off will be able to afford truly self-sufficient homes. Solar domestic water heating systems, however, will become de facto in new home construction, and will improve the resale value for existing ones.

We will probably begin to see a

shift in housing demographics away from the suburbs, as people begin to migrate either “inward” to the convenience of the cities or “outward” to the safety of more rural areas (most likely to communities about 1 ½ to 3 hours from a major city). Furthermore, many people in cold climates will begin to move southward, while people in extremely hot climates move a little further north. Lastly, some will decide to leave the country altogether, perhaps in an effort to stretch the value of their remaining savings as far as possible.

The “whole foods” movement will really begin to latch-on in Western societies, as industrialized, processed foods, meats and milk become more expensive than locally produced goods. This, combined with economic hardship and unemployment, will lead many people—especially those in small towns—to rediscover to some extent an economy of barter and local markets.

Social discomfort will erupt in various ways, and we could expect at least a couple incidents of

large-scale rioting in one or more large cities (highest probability lies with Los Angeles). More common will be the rising presence of anti-government and anti-corporate sentiment. In the drive to become independent of the high costs of social infrastructure, many will embrace the

emerging popularity of sustainable-living communities, or eco-villages. This will lay the groundwork for how our society will overcome the Crisis period, and will involve a re-discovery of the “local economies” that people participated in before hydrocarbon energy fueled the Industrial Age.

Movies will begin to take on much lighter, more uplifting subject and tone. The classic Musical may return as a popular style.

There is some chance—probably somewhat less than 50/50—that the US may see a legitimate Third-party contender for the Presidency in 2008. If so, it would be a populist candidate running on a platform of public austerity and a return to the pre-Wilson ideology of US independence from international imperialism and diplomatic endeavors.

2011-2015By this time period, the “impending-ness” of Peak Oil will be much more apparent. If no significant new reserves have been discovered, or conversely if China / East Asia have not experienced an economic collapse, then the developed countries of the world will find themselves in a position of extreme desperation to take direct control of the world’s supply from whomever currently has it—which will mean

world war, concentrated in the Middle East, especially Saudi Arabia. Even if new reserves are found, where they are discovered will be a significant factor. If sufficiently large reserves are found in North America, violent crisis will be easily avoidable for the time being. The chance of this is extremely unlikely, however. Therefore, it needs to be recognized that if these events ensue then, because oil will mean life-or-death for the developed (and even under-developed) nations of the world, any conflict will quickly escalate to the use of nuclear and other “weapons of mass destruction”. If this happens then there will be no way to predict how the future will unfold, and the rest of the predictions for this period will be either accelerated or just moot….

In the US,

oil and gas will gradually become more regulated as it is concentrated in places of greatest need, such as electrical generation, agricultural production, water processing, necessary transport, military uses, etc. Undoubtedly some kind of high-level (regulated) and/or low-level (unregulated) black market will develop, especially for gasoline. On the renewable front, solar photovoltaic systems may become more widespread, especially if sufficient investment has been made over the past few years to encourage the PV manufacturing industry.

Life in the cities will begin to break down, as basic services become unreliable and fresh food becomes scarce, and lines will frequently form at grocery stores when shipments come in. Things like blue jeans and tennis shoes may become luxury items. Crime of all kinds will have increased dramatically. Racial strife may flare up in some cities. Western communities will probably find that access to water becomes a point of contention, as rivers and reservoirs become coveted resources, especially around Denver, Phoenix and Southern California.

Even as city life becomes more difficult, many

rural towns will experience a rebirth as they find themselves reorganized into eco-villages and self-sustaining communities, experiencing an influx of educated, industrious individuals. Life will begin to de-centralize (from an urban-centric structure) and regionalize (around natural resources), and the price of arable land and “hobby farms” will skyrocket. With this return to small, prosperous communities where whole families will be working together for the benefit of the community, a renewed sense of spirituality may begin to bloom. As distribution to these rural areas becomes costlier and more problematic, many things will become unavailable outside of the cities: fast food restaurants will close, as will many other chain stores, and things like truck stops, overnight hotels, and billboards might begin to disappear. However, items that are difficult to manufacture locally will also become scarce, or disappear altogether from smaller communities: electronics (including computers and cell phones), pharmaceutical medicine and medical supplies, plastic and rubber items, etc. Also, rural life may not be entirely safe and secure, as it’s likely that many people with more fearful, xenophobic tendencies will adopt the Survivalist mentality and form paramilitary communities far from the cities. This may lead to civil conflict over local land and resources, which would entail further government intervention in domestic security. More likely, however, is that most these groups will just bunker down with their fingers on their triggers until society appears to stabilize, and then seek to reunite and find a place within more organized and prosperous communities.

In developing countries, it seems likely that poverty and food scarcity worldwide will lead to civil disorder and social strife, especially in urban areas. This may in turn lead to government intervention in the daily life of people. There is some chance that outbreaks of disease will take their toll, especially in Africa, India, China, East Asia and Indonesia, as medical treatment becomes difficult to sustain at suitable levels and malnourishment and breakdown in social services become more widespread.

My closing thoughts: it's a pretty dire viewpoint but very plausible considering the events that are unfolding (food shortages looming, consumer inflation raging, Unprecedented US debt levels (consumer/corporate and gvt), dollar falling quickly, oil becoming scarce while demand increases, G7 financial crisis unwinding, China/Russia bonding and their control of natural resources growing, and the list goes on...)

Guess only time will tell, but I think Steve's viewpoint is worth serious consideration in any future planning.

Regards

Randy