At that time, I knew the situation was grave and opined that the Plunge Protection Team (PPT) was wide awake at night, trying to find a solution -- otherwise the last leg of confidence in their "Goldilocks" economic charade would fail.

Here's my Sunday Evening, March 16th, 2008 post: Tumultuous Week Ahead

Lo and Behold, within hours of that post, opening markets around the globe began to tumble -- causing the PPT to panic and come out fighting (on a Sunday night)... With their big cannons and guns ablazing, it was announced the Fed would immediately:

Modify the Discount Window -- On March 16, 2008, the Fed further extended the term for borrowing to 90 days, and further reduced the spread to the target federal funds rate to 25 basis points.

Open the Primary Dealer Credit Facility -- The establishment of the PDCF was announced on March 16, 2008. The Board determined that unusual and exigent circumstances existed in financial markets, including a severe lack of liquidity that threatened to impair the functioning of a broad range of markets, and announced that the PDCF will be in place for at least six months and may be extended as conditions warrant.

These two new unparallelled additions would immediately join two other unprecedented actions taken earlier in the year:

- The Term Auction Facility (TAF) in Dec 07

- The Term Securities Lending Facility (TSLF) on March 11, 08

Within days, easy liquidity created through these four new monetary spigots started to calm markets, and as increasing gains were made many shills began to pronounce: "The Credit Crisis is Over".

Well, here we in June 08 and things aren't looking so well again...

With recent reports of:

- The biggest jobless increase in over two decades

- The largest housing bust since the Great Depression

- Oil/gas at an all-time high

- Contagion spreading across the banking sector (significant losses ahead)

- Recent MBIA and AMBAC downgrades

Last Friday's 400 point drop in the DOW should have been a wake-up call.

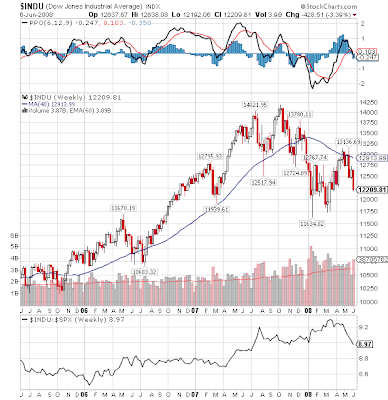

Let's look at a chart of the DOW:

Note: I'm not a chartist, but I do have a lot of common sense and believe that anyone can relate to/understand what I'm about to say.

Looking at the chart above, last Friday the DOW closed at 12,209. On the assumption more bad news will follow in the days/weeks ahead, where can one expect to see the next level of downside support and will we eventually break through it?

If you follow the chart over to March 2007, you will see that 11,939 is the next downside support level. If we break through there, it's quite likely we will also test the following downside support level-- found in Jan 08 at 11,634. Now, this 11,700-11,600 level will provide very strong downside resistance and the PPT will fight tooth and nail to prevent failure, but if we DO break through it -- look out below as automated sell signals kick in from around the Globe—potentially creating a selling panic/free-fall.

From there it's a 1,000 point drop to the next downside support level -- July 2006 @ 10,683.

Closing:

I don't expect to open in a free-fall tomorrow or the next day, but want you to be aware that we're only 300 points from breaking through key downside support levels. Once that happens (which I'm sure it will in the coming weeks) the next support level @ 11,700-11,600 becomes very vulnerable -- and if that one doesn't hold, expect all hell to break loose as the last leg of propped-up confidence in our economy gives way to unknown panic/crisis.

With that said, and expecting more bad news to roll in each and every day, I feel quite confident in stating that both of these downside support levels will eventually be broken (this year), but the real question ultimately relates to timing and the PPT -- What else do they have up their sleeves? No one yet knows, but expect a fight.

Best Regards

Randy

Economicrot.blogspot.com

.

10 comments:

I've watched this mess develop as these so called economic wizards perform their chicanery, all the while wondering what they are thinking. I've been a strong conservative and believe in living within my means, lessons I was taught as a young man growing up on a farm. I've also known that there are a large group of people that are much more liberal (big government oriented)than I feel is necessary. These are not bad people just people with a different point of view, based upon different experiences and needs. However I'm at a point that I sincerely believe that most of big business (large banks and global empires)could care less about liberals, conservatives, or even the constitution. They have bought the U.S. government and are dictating terms. What makes me feel bad is that this point of view is considered on the lunatic fringe and I didn't arrive at this position without a lot of careful study.

All I can say is buy physical silver and/or CEF because the barn door has blown open.

I agree, but let’s just say that silver does begin to spike and the dollar tanks. This means transportation virtually shuts down as fuel prices surge to $5, then $6, and $7 dollars. The commute to work, for those who still have jobs, begins to cost a thousand a month. Grocery prices double, if not triple and shortages appear everywhere. Soon after that people start to get upset and anger takes the form of demonstrations, then riots, then looting and finally open disregard for laws and personal property. Meanwhile the government, which has been totally incompetent with the financial mess, is forced to declare marshal law. By November whichever figurehead is installed as President is virtually powerless to do anything but carry out the confiscation of property to keep the elite isolated from the masses. I can see this happening in months as Credit Derivative Swaps and who knows how many other magic money formulas grow beanstalks. What happens then when I show up at a store with a silver dollar to buy milk for my grandkids? Will they let me out alive?

You Doom & Gloomers have been predicting the end of the world since 1979. This is the best economy in 85 years and you know it.

yayarail

It is the best economy for who?

You prove my point of lunatic fringe. Ask why and if you don't have the current media answer you're labeled.

The doom & gloomer post by anon must be a realtor. lol

If gas prices resist any downward trend from the $4 level it will crush the consumer/commuter.

I too am a fiscal conservative (live within your means) but vis-a-vis our economic system, a social radical....

Our choices to "change" the system are narrowed every time we have another "fiscal" crisis.

Why do you think so many of our political individual (national) are now calling for "more regulation?"

Because they (both parties) have given into major capital flows and have totally disregarded the common person forced to participate in a flawed system.

My personal observation (I'm 77) is that the "Dow" belongs at the "8700" level to give any reflection of historical "fair value," less the incredible modular securities that have flooded our markets since the '90's.....

Good luck!

Whenever business man not take care of Currency rates they will be faced trouble ahead. So take care of it.

Nice chart

Post a Comment