Lehman shares plunge on capital raising fears

Lehman Brothers Holdings Inc shares tumbled to close at nearly a 5-year low on Tuesday on concern that Wall Street's smallest surviving major brokerage may need to raise more capital.

The upheaval at Lehman -- which has already cut thousands of jobs and raised $4 billion to cushion the impact of previous write-downs -- was the latest reminder that it and larger rivals may be struggling to put the credit crunch behind them.

Afternoon Reading: Following the Bear’s Tracks?

As Felix Salmon over at Portfolio.com writes: “We’ve seen this movie before, most memorably at Bear Stearns. The fact is that during a credit crunch, when you’re stuck with illiquid assets, you can’t hedge them.”

Plenty of people are betting that Lehman implodes, says Ben Bittrolff at The Financial Ninja. “The open interest in LEH puts is absolutely massive, especially at strikes that would only pay off if LEH completely imploded (a la Bear Stearns). Either some idiots are going to be out a lot of money come June, July and October… or LEH implodes before then…”

Whether or not Lehman faces the same fate as Bear, one thing is clear: The spotlight is shining brightly on Lehman CEO Dick Fuld, a day after Wachovia CEO Ken Thompson lost his job and Washington Mutual’s Kerry Killinger was stripped of his chairman title. (He remains CEO.)

So is Fuld’s head the next to roll? Douglas A. McIntyre over at 24/7 Wall St. thinks so, writing “his board can no longer protected him from a series of bad decisions.”

Finally, check out this graphic from Portfolio.com on which CEO is next to go.

Bear Stearns replay? Lehman Bros. back in the rumor mill

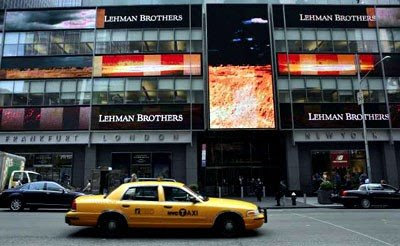

Ever since the stunning demise of Bear Stearns, the spotlight has been fixed on Lehman because of the inescapable similarities between the two companies. Both were bond powerhouses and major progenitors of mortgage-backed securities. They were the two smallest of the five major independent investment banks. And Lehman's midtown-Manhattan headquarters are just a few blocks from Bear’s.

Just a few weeks ago, with its stock rebounding to more than $47 a share, Lehman appeared to be getting past the concerns about its financial viability. But it has never quite been able to put them completely to rest.

Questions arose last month about whether the firm had adequately hedged its exposure to some risky assets. And a high-profile critic, hedge fund manager David Einhorn, contends that Lehman masked its exposure to troubled credit markets through debatable accounting maneuvers.

When combined with other unsettling financial-sector news in recent days, including the ouster of Wachovia Corp.’s CEO, investors are rethinking whether the credit-crunch-related woes of the banking sector are over, as many investors had been hoping.

"We've gone from, 'hey it’s the ninth inning’ to, ‘maybe it’s the fith inning'," said Kevin Kruszenski, director of trading at KeyBanc Capital Markets in Cleveland. (My Put -- more like the second inning)

Lehman Fights an Investor Trying to Drive Down Its Stock

David Einhorn thinks another big Wall Street bank is headed for trouble — and he is not being quiet about it.

For eight months now, Mr. Einhorn, a rabble-rousing hedge fund manager, has pilloried the venerable Lehman Brothers in an effort to drive down the bank’s stock price, which he is betting against.

Lehman Brothers is not amused. In recent weeks, the bank’s chief financial officer, Erin Callan, has tried privately to rebut Mr. Einhorn to nervous investors, who have feared for Lehman’s health ever since Bear Stearns succumbed to a panic. But despite Ms. Callan’s efforts, Lehman’s stock keeps falling: It tumbled 9.5 percent more on Tuesday, in a deluge of selling, bringing its loss for the last 12 months to 59 percent.

The battle over Lehman has captivated Wall Street and left the bank struggling over what to do next. The bank, which is expected to post a quarterly loss of roughly $1 billion in a few weeks, may also raise capital to shore up investor confidence. The bank has sold more than $100 billion in assets in recent months to shore up its finances, according to a person close to the company. That person said new capital would most likely come from a source other than the public markets.

Mr. Einhorn, who runs a $6 billion hedge fund called Greenlight Capital, has been profiting from the Lehman’s growing pain. Critics say he is needlessly fanning fears about the precarious health of the financial industry at the very moment executives are struggling to stabilize their ailing companies. Many on Wall Street still wonder if hedge funds like Greenlight helped bring down Bear Stearns and spread false rumors about the bank, a possibility the Securities and Exchange Commission is investigating.

In an interview on Monday in his Midtown offices, Mr. Einhorn, fresh from his latest round of television appearances, said he was not out to tell Lehman Brothers how to fix its problems. He questioned how the company valued the assets on its books, and whether it was disclosing all the risks it faces. Investors have good reason to question banks: Worldwide, financial companies have suffered more than $380 billion in write-downs and credit-related losses in the last year, laying bare their shoddy risk management. Lehman has been singled out because of the large role it played in the mortgage market and its reluctance to disclose information about its assets compared with other Wall Street banks.

“Lehman has been one of the deniers,” Mr. Einhorn, 39, said.

Mr. Einhorn said he began betting against Lehman’s stock last July, and he has been right so far. But things have not always gone his way. His long battle against the Allied Capital Corporation prompted the S.E.C. to investigate comments he had made about that company, an episode he discusses in his new book, “Fooling Some of the People All of the Time,” which he is busy promoting. And he was a board member and longtime fan of the New Century Financial Corporation, a big subprime mortgage company that filed for bankruptcy last year.

Still, Mr. Einhorn could be a thorn in Lehman’s side for years to come. For six years he has been using a short trade as a way to bet against a rise in the stock price of Allied Capital and MBIA, the bond reinsurance company.

“He’s got a lot of conviction, and he persists in his convictions for a long time,” said Adam Zoia, managing partner of Glocap, a recruiter in New York that has worked for Mr. Einhorn.

Mr. Einhorn instigated the latest dive in Lehman’s stock price two weeks ago when he encouraged other investors to short the stock at a large conference in New York. When Standard & Poor’s lowered its debt rating for Lehman and several other Wall Street banks on Monday, Mr. Einhorn joined the ratings agency’s conference call on Tuesday and asked whether the agency reviews Lehman’s valuations of its assets.

Ms. Callan, 42, spent an hour on the phone with Mr. Einhorn answering questions before his speech. Afterwards, she found herself rebutting some of his assertions to investors.

On Tuesday, Lehman issued a public statement denying market rumors that it had turned to Federal Reserve for cash through a special program put in place after Bear Stearns collapsed. Ms. Callan and other Lehman executives declined to comment on Mr. Einhorn for this article.

It is impossible to quantify Mr. Einhorn’s influence on Lehman’s stock price. But hours before his speech two weeks ago, trading volume exploded for Lehman stock puts, which are options to sell the stock and profit if its falls. That day, more than 200,000 put contracts against Lehman were sold, up 49 percent from recent typical Lehman put trading.

Brad Hintz, the banking analyst at the Sanford C. Bernstein & Company and Lehman’s former chief financial officer, said he could hardly walk a few feet at a conference at the Waldorf-Astoria last week without having investors ask him about Mr. Einhorn’s views.

Lehman’s management has spoken with some analysts about Mr. Einhorn, but they have declined to comment publicly beyond a statement that says Mr. Einhorn “cherry picks” and misconstrues information.

“They’re furious,” Mr. Hintz said. “If you get distrust of your accounting, then it affects the valuation of the company forever going forward.”

Within Lehman, workers are calling Mr. Einhorn’s strategy “short and distort.” Many hedge fund managers talk freely with one another about companies, but they typically shun publicity. Mr. Einhorn, by contrast, is working with a financial public relations firm, the Gordon Group, to promote his book and views on stocks.

“His position on shorting Lehman is only going to get traction and be successful if he can succeed in convincing people to drive down the stock,” said Michael Claes, a managing director at the public relations firm Burson-Marsteller. “That’s best accomplished with media exposure.”

But Mr. Einhorn’s public approach leaves him open to being criticized himself. Mr. Hintz of Sanford Bernstein said in a report on Monday that supporters of Mr. Einhorn’s latest arguments are “piling on” against Ms. Callan. And Buckingham Research Group said his concerns were “just wrong.”

“These recent criticisms also seem will-timed to take advantage of the market’s concern around weak second-quarter results that we expect for Lehman,” the Buckingham analysts wrote in a report.

Lehman, to be sure, will have to explain its second-quarter earnings to be announced in the next two weeks. Ms. Callan has said the bank will take more write-downs and that some hedge trades were not effective.

Lehman, like its counterparts, is racing to use less leverage. The bank had a gross leverage ratio of 31.7:1 at the end of the first quarter, meaning it had borrowed $31.70 for each dollar of equity. Lehman has whittled that ratio down to 25:1 through its more than $100 billion in asset sales, said the person close to the company who was given anonymity because he was discussing a pending financial filing. A small amount of the sales were to two hedge funds set up by former Lehman executives.

Mr. Einhorn likes to point out that Lehman’s management has incentives to be positive since compensation is tied to performance. Short sellers, he said, receive undue skepticism, and he said he thought he would be getting far less attention if he were discussing a positive view on a company.

Aside from Lehman, Mr. Einhorn would not say if he is long or short other financial companies. But Greenlight Capital has twice as much money invested in long positions across its entire portfolio than it does shorts, he said. So a collapse of Lehman that turned into a broad economic panic could hurt Mr. Einhorn, too.

He said he would keep the Lehman trade going until he is proven right — or wrong.

“The faster the better,” Mr. Einhorn said, “but the world doesn’t work on my schedule.”

6 comments:

Las Vegas called 'mortgage fraud ground zero' - USATODAY.com

LAS VEGAS — In the shadow of Sunrise Mountain, where Rolling Hills Drive turns into Gold Mine Drive, a plain two-story home sits unoccupied, like thousands of other houses here in southern Nevada.

Some of these empty homes have "for sale" signs. Others bear signs saying "foreclosure." Authorities say hundreds of them, including this one on Rolling Hills Drive, should have a different sign out front, one that reads "fraud."

Prosecutors contend this house was sold last year to a straw buyer as part of a sprawling mortgage fraud perpetrated by a husband-and-wife team involving 277 properties in greater Las Vegas.

http://www.usatoday.com/money/economy/housing/2008-06-02-mortgage-fraud-las-vegas_N.htm?csp=34

Ed McMahon May Lose Beverly Hills Home

Ed McMahon, the longtime sidekick to television star Johnny Carson, faces the possible loss of his Beverly Hills home to a foreclosure action initiated by a unit of Countrywide Financial Corp.

http://online.wsj.com/article/SB121254369208443705.html

Fliers in for pain as airlines pack it in - USATODAY.com

The USA's air-travel map is shrinking fast, dropping scores of routes and flights that airlines simply can't afford anymore in a world of $130-a-barrel oil.

A USA TODAY analysis of fall airline schedules shows the nation's most popular vacation destinations will be among the biggest air-service losers. Many flights to Honolulu, Orlando, Las Vegas and other favorite vacation venues have vanished or will soon because cheap tickets bought by tourists don't cover the cost of getting there.

http://www.usatoday.com/travel/flights/2008-06-03-airlines-cuts-flights-fares_N.htm?csp=34

Recession Hits Las Vegas Shows

The halls of the JCK Las Vegas show this Saturday were clearly less crowded than last year, and almost all exhibitors noted a decrease of traffic into their booths. Walk-ins, visitors without prior appointments, were not only less present in lower numbers, but a number of exhibitors also noted they were less inclined to place orders.

http://www.idexonline.com/portal_FullNews.asp?id=30423

- PDM

Developers scrap $5 billion Las Vegas casino plan

A development group planning to build a 5,000-room hotel and skyscraper on the Las Vegas Strip has scrapped the project, owing to difficult credit- market conditions, according to one of the partners in the joint venture Wednesday.

http://www.marketwatch.com/news/story/developers-scrap-5-billion-las/story.aspx?guid={5C8C6D9A-7084-4291-9463-B25140528DEC}

Thanks for the links gents. I'll check them out. Sorry took so long to reply... very busy last two days.

Randy

Post a Comment